Q. Can my credit card company increase my minimum payment?

Credit card issuers can increase your minimum payment due to several factors. Depending on the issuer, your balance, interest and fees could affect the cost. Depending on the issuer, your minimum payment may also include interest, late fees, amounts that exceed your credit limit, or installment plan payments.

Q. How can I get my credit card company to lower my minimum payment?

Here are nine common-sense ways to shrink your credit card payment.

Table of Contents

- Q. Can my credit card company increase my minimum payment?

- Q. How can I get my credit card company to lower my minimum payment?

- Q. Can I pay more than minimum amount due in credit card?

- Q. Is paying the minimum on a credit card bad?

- Q. Will credit card interest rates go up in 2021?

- Q. How much should you pay over your minimum payment?

- Q. Why do I have to make minimum payments on my credit cards?

- Q. How to reduce your average credit card payment?

- Q. How much will Barclaycard increase minimum credit card repayments?

- Q. Which is the slowest way to pay off a credit card?

- Make Larger Payments Now.

- Reduce Credit Card Spending.

- Stop Using Your Card Entirely.

- Negotiate Lower Interest Rates.

- Transfer Your Balance.

- Prioritize Payments.

- Ask Your Card Issuer for a Payment Plan.

- Improve Your Credit Score.

Q. Can I pay more than minimum amount due in credit card?

Paying more than the minimum will reduce your credit utilization ratio—the ratio of your credit card balances to credit limits. That’s because it isn’t the total amount of debt that matters, but the percentage of available credit that you’re currently using that really matters.

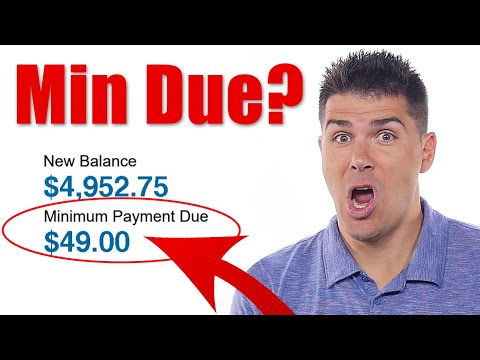

Q. Is paying the minimum on a credit card bad?

Offering only the minimum payment keeps you in debt longer and racks up interest charges. It can also put your credit score at risk. Making only the minimum payment on your credit card keeps your account in good standing and avoids late fees, but that’s about all it does.

Q. Will credit card interest rates go up in 2021?

McBride predicts the average credit card interest rate will rise to 16.15 percent in 2021, despite an otherwise static interest rate environment.

Q. How much should you pay over your minimum payment?

It’s best to pay more than the minimum “Honestly, you should pay as much as you can afford to pay without derailing your other financial obligations,” McClary of the NFCC says. Try to pay double the minimum payment, if you can afford it. If that’s a no-go, consider paying $10 or $20 more than the minimum, he suggests.

Q. Why do I have to make minimum payments on my credit cards?

Paying just the minimum increases both the total interest and the time it takes to pay off your credit card balance. Take inventory of your credit card accounts by making a list of all your credit cards along with the amount you owe on each, the minimum payment, and the interest rate.

Q. How to reduce your average credit card payment?

How to Reduce Your Average Monthly Credit Card Payments 1 Average Debt in the US. 2 Pay More Than the Minimum Monthly Payment. 3 Prioritize Your Debt. 4 Review Your Budget. 5 Consider Options for Reducing Interest Rates. 6 Pick a Debt Repayment Strategy. 7 Put the Brakes on New Purchases.

Q. How much will Barclaycard increase minimum credit card repayments?

Barclaycard won’t say how many customers are affected (though most of its cards are – see a full list below) or what the typical change will be. However we’ve heard from customers who’ve been told they’ll see increases of between 30% and 58% as a result – with one told their monthly repayment will jump from £87 to £137.

Q. Which is the slowest way to pay off a credit card?

Making minimum payments alone can be the slowest way to pay off credit card debt—especially if you’re making new charges on the card each month. Exactly how long it takes to pay off a credit card with minimum payments depends on your balance, minimum payment amounts and the card’s interest rate.