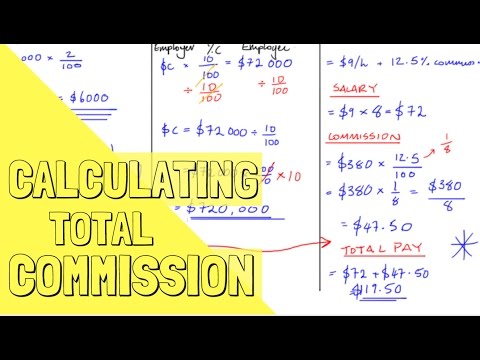

Q. How do you calculate commision?

A commission is a percentage of total sales as determined by the rate of commission. To find the commission on a sale, multiply the rate of commission by the total sales.

Q. Is commission calculated on gross or net?

The commission is usually based on the total amount of a sale, but it may be based on other factors, such as the gross margin of a product or even its net profit.

Table of Contents

- Q. How do you calculate commision?

- Q. Is commission calculated on gross or net?

- Q. How does working on commission work?

- Q. How do Realtors calculate commission?

- Q. Should I work for commission only?

- Q. Can you be employed on commission only?

- Q. Does Commission get taxed more?

- Q. How do I hire someone on commission?

- Q. Can jobs 100% commission?

- Q. Is 100 percent commission bad?

- Q. What is a 70/30 compensation plan?

- Q. Is Commission Better Than Salary?

- Q. What is a disadvantage of commission?

- Q. Is getting paid commission good?

- Q. What jobs are commission-based?

- Q. What is a commission fee?

- Q. What are the highest paying commission jobs?

- Q. How often should commissions be paid?

- Q. Can I sue for unpaid commissions?

- Q. What is good commission rate?

- Q. Are Commission considered wages?

- Q. Can an employer refuse to pay commission?

- Q. Can a company make you pay back commission?

- Q. Can a company hold your commission check?

- Q. Can a company change your commission without notice?

- Q. Can you take away Commission?

- Q. What happens to commission when item is returned?

- Q. Can my employer change my commission?

- Q. Are commission clawbacks legal?

Q. How does working on commission work?

A sales commission is a sum of money paid to an employee upon completion of a task, usually selling a certain amount of goods or services. Employers sometimes use sales commissions as incentives to increase worker productivity. A commission may be paid in addition to a salary or instead of a salary.

Q. How do Realtors calculate commission?

The real estate commission calculator works by calculating a simple equation: The agreed-upon payment percentage/100 x the price of the property. For example, if a homeowner sells their home for $200,000, and the commission rate is 5%, the equation would be (5/100) x 200,000 = $10,000 commission.

Q. Should I work for commission only?

For the most part, commission-only gigs are flexible ones. That means that you can set your schedule as you need to in order to facilitate both professional and personal demands on your time. For job seekers looking for work-life balance, a commission-only job can be a great fit.

Q. Can you be employed on commission only?

It’s not legal to have an employee and only pay them commission, unless you guarantee that the commission equals or exceeds the National Minimum Wage. So in other words, you can call it commission but it needs to be guaranteed commission so in effect, it’s a salary.

Q. Does Commission get taxed more?

Yes and no. At tax filing time, all compensation is taxed the same. But employers are required to withhold federal income tax, on lump sum payments (like a bonus), at the higher 22% rate. Commission, paid each pay period are not subject to the higher rate.

Q. How do I hire someone on commission?

Here are 10 steps to hire 100% commission sales reps in today’s job market:

- Know your commission structure.

- Have a professional and updated website.

- Have a recruiting and onboarding process that works.

- Expect to pay when recruiting.

- Hire multiple sales reps at the same time.

- Have an award-winning sales training program.

Q. Can jobs 100% commission?

Professionals working on 100% commission jobs usually earn more than those doing jobs that are paid a base salary. In case of an increase in sales, then the commission agent sells more and therefore gets a higher income on a monthly basis – that can a lot more in comparison with a person that has a wage.

Q. Is 100 percent commission bad?

100% commission means that you only get paid if and when you sell whatever product or service your company offers. 100% commission can be great if your company makes a great product or provides a great service; and it is an amazing value to clients who want what you are selling.

Q. What is a 70/30 compensation plan?

A 70/30 pay mix allocates 70 percent of the target total compensation to base salary and 30 percent to target incentive. Pay mixes vary from 50/50 to 85/15. Use a more aggressive pay mix for “high influence” sales jobs and a less aggressive pay mix for “lower influence” sales jobs.

Q. Is Commission Better Than Salary?

Even though many positions pay a base salary, the value of working for commission is that you are in control of what you earn. Highly motivated salespeople will earn generous commissions, while their less ambitious counterparts will not. There are also some jobs that are more lucrative than others.

Q. What is a disadvantage of commission?

Disadvantages of Commission-based Pay They will fail to fully explain their products or services to potential customers. The same goes for overly aggressive sales methods wherein new customers may be turned off by too much hard selling and other high-pressure tactics.

Q. Is getting paid commission good?

Attracts Best Salespeople: Since commission selling provides higher earning potential than a straight salary plan, it tends to attract top-performing salespeople who know they have the skills to produce a good income.

Q. What jobs are commission-based?

Top 7 Commission-Based Jobs

- Sales Engineers.

- Wholesale and Manufacturing Sales Representatives.

- Securities, Commodities, and Financial Services Sales Agents.

- Advertising Sales Agent.

- Insurance Sales Agent.

- Real Estate Brokers and Sales Agents.

- Travel Agents.

Q. What is a commission fee?

Commission fees are charged by a brokerage when you buy or sell a stock, ETF or other type of investment product. Traditionally, they range in price, depending on the company, from anywhere to $1 to $50. That started to change a few years ago.

Q. What are the highest paying commission jobs?

Here’s a look at eight sales jobs where your base salary and commissions could add up to six figures:

- Consulting sales. Base Salary: $120,000 to $250,000.

- Consumer packaged goods sales.

- Digital media sales.

- Medical-device sales.

- Outsourced services.

- Software sales.

- Startup business development.

- Telecommunications sales.

Q. How often should commissions be paid?

Once your commissions are earned, however, California’s regular payday laws apply. This means you must be paid at least twice a month, including any commissions that you’ve earned. For commissions earned between the 1st and the 15th of the month, you must be paid no later than the 26th of that month.

Q. Can I sue for unpaid commissions?

Wage Claims Seeking Unpaid Commissions☍ If their employer violates their commission agreement, they can file a wage claim with the State of California’s Division of Labor Standards Enforcement. Aggrieved employees might also have the right to file a lawsuit against their employer.

Q. What is good commission rate?

The typical commission rate for sales starts at about 5%, which usually applies to sales teams that have a generous base pay. The average in sales, though, is usually between 20-30%. What is a good commission rate for sales? Some companies offer as much as 40-50% commission.

Q. Are Commission considered wages?

Commission-based Pay: An employee who earns commission is leaving the company. All wages earned by an employee must be paid upon termination, and by definition, commissions are considered wages.

Q. Can an employer refuse to pay commission?

Unfair Commission Policy Once an employee has fulfilled all of the requirements for earning a commission, the employer has no choice but to pay that commission. An employer cannot refuse to pay a commission because, for example, the employer is not happy with the employee’s overall performance.

Q. Can a company make you pay back commission?

Most courts agree that employee charge backs are legal so long as it is indicated in the employment contract between the employee and the employer. If the employer fails to state any desire to charge back in the contract, courts generally assume that an employee is entitled to keep the extra commission.

Q. Can a company hold your commission check?

Employers and employees typically enter into a written contract that outlines details of how commissions will be earned and paid. If the agreement does not say you can withhold the employee’s commissions, the employer must pay according to the terms of the contract.

Q. Can a company change your commission without notice?

Your employer cannot retroactively change your commission structure for work that has already been completed. Your employer must give you notice of some kind about the upcoming change, but the notice does not necessarily need to be in writing.

Q. Can you take away Commission?

Shouse Law Group » California Blog » Can an employer reduce or take away my commission in California? Generally, an employer cannot take away or reduce a commission that an employee has already earned. Those situations, though, are limited by state law and have to be clearly written in the commission agreement.

Q. What happens to commission when item is returned?

That means sales. A return is the opposite of a sale, but is something every business must deal with (unless they explicitly say ‘all sales are final’). So if a salesperson got paid a commission on a sale, they ‘should’ have to repay that commission if the item is returned.

Q. Can my employer change my commission?

Sales Commissions – Can An Employer Change The Agreement After a Sale? After the employee has a signed document stating what the commission agreement is when sales occur, the document cannot alter the terms to increase or decrease the commission granted from a sale without a breach of contract.

Q. Are commission clawbacks legal?

They are perfectly legal, but how much you can “claw” back, as well as when and how, can vary drastically from state to state. As an initial matter, it is important to note the type of commission payment subject to the clawback effort.