Q. How do you calculate environmental lapse rate?

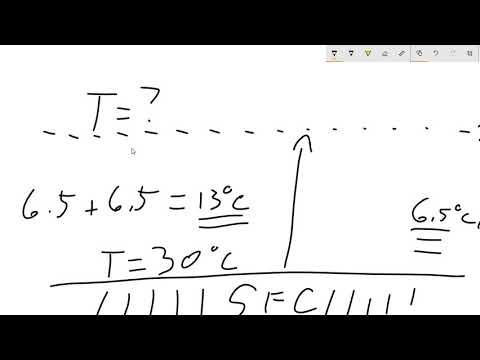

The temperature decreases with height. The temperature lapse rate in an atmosphere is the rate of decrease of temperature with height; that is to say, it is −dT/dz.

Q. What is the normal lapse rate at 1000?

The average or normal lapse rate says that the average change will be 3.5�F per 1000 feet elevation change. This change occurs partly due to the greenhouse effect and partly due to the lower density of the air. The normal lapse rate is especially useful to compare temperatures.

Table of Contents

- Q. How do you calculate environmental lapse rate?

- Q. What is the normal lapse rate at 1000?

- Q. What is the standard lapse rate of pressure as you increase in altitude?

- Q. What does lapse of time mean?

- Q. Is lapsed in a sentence?

- Q. What is a mental lapse?

- Q. What is lapse coverage?

- Q. How long can you let your insurance lapse?

- Q. How long does a lapse in car insurance stay on your record?

- Q. What insurance companies only check 3 years?

- Q. How long can you drive without insurance after buying a car?

- Q. What Car insurance companies look back 3 years?

- Q. What is the best car insurance for a 20 year old?

- Q. What is the best insurance company for high-risk drivers?

- Q. Why do insurance companies ask for convictions in last 5 years?

- Q. Do insurance companies check convictions?

- Q. How long does an IN10 affect your insurance?

- Q. Does a criminal record affect car insurance?

- Q. What happens if I don’t disclose a conviction?

Q. What is the standard lapse rate of pressure as you increase in altitude?

Above this point, the temperature is considered constant up to 80,000 feet. A standard pressure lapse rate is when pressure decreases at a rate of approximately 1 “Hg per 1,000 feet of altitude gain to 10,000 feet.

Q. What does lapse of time mean?

Meaning of lapse of time in English a period of time that passes: the reason for a legal agreement ending, because an agreed time limit has passed: The contracts had been terminated because they had expired by lapse of time.

Q. Is lapsed in a sentence?

He nodded and lapsed into silence. Once again they lapsed into silence, but again Jennifer Radisson made no move to leave. A few seconds lapsed before she realized that someone had skipped a stone.

Q. What is a mental lapse?

a : an occurrence in which you fail to think or act in the usual or proper way for a brief time and make a mistake. He blamed the error on a minor mental lapse. As he grew older he began to have memory lapses.

Q. What is lapse coverage?

What’s a lapse in coverage? A lapse in coverage is when you go from having auto insurance to not having it. It’s still a lapse in coverage, even if it’s just for a day or two. To an insurer, a lapse in coverage looks like you chose to drive uninsured or you can’t keep up with your payments.

Q. How long can you let your insurance lapse?

Insurance lapse grace period Depending on the state, you’ll usually have between 10 and 20 days. Your company will notify you by mail or email before cancelling your coverage. See more on the grace period when purchasing a new vehicle.

Q. How long does a lapse in car insurance stay on your record?

three to five years

Q. What insurance companies only check 3 years?

Notable car insurance companies that only look back 3 years for violations and claims include Progressive and State Farm. Many car insurance providers only look back at the past 2-3 years on a customer’s driving record to check for claims on an insurance policy or minor moving violations.

Q. How long can you drive without insurance after buying a car?

around 20 days

Q. What Car insurance companies look back 3 years?

#1 – How far back does Progressive look at your driving record? Progressive auto insurance will look back up to three years for speeding tickets and other traffic violations.

Q. What is the best car insurance for a 20 year old?

USAA, available to military members and their families, was the second most affordable. Among widely available insurance companies, Geico ranked as the most affordable for 20-year-olds, with average rates of $3,304 per year.

Q. What is the best insurance company for high-risk drivers?

Compare Best High-Risk Car Insurance Companies

| Provider | Best For |

|---|---|

| The General | Best For Minimum Coverage |

| Dairyland | Best For Drivers Needing An SR-22 |

| State Farm | Best Rates After a DUI |

| GEICO | Best Rates After a Traffic Violation |

Q. Why do insurance companies ask for convictions in last 5 years?

All convictions which result in an endorsement to a licence will need to be disclosed for at least five years.” An Aviva spokesman said: “We ask customers to declare convictions over the last five years because it gives us important information as to how they drive.

Q. Do insurance companies check convictions?

Why am I asked about convictions? Most insurance companies ask about criminal convictions because they believe it is relevant to the risk. The questions will normally include the convictions of everyone covered by the policy, such as children or a partner. If you are not asked, you do not need to disclose.

Q. How long does an IN10 affect your insurance?

five years

Q. Does a criminal record affect car insurance?

Having a criminal record will increase the cost of your car insurance, whether your conviction is motoring-related or not, because insurers see you as a greater risk. All convictions matter to your insurer, regardless of the crime, including robbery and driving under the influence of drink or drugs.

Q. What happens if I don’t disclose a conviction?

Many employers ask at some point and if your convictions are unspent, you legally need to disclose them. If they ask you and you don’t disclose, they could later revoke the job offer or you could be dismissed. You could even face a further conviction.