Q. How do you find the probability of two independent events?

Probability of Two Events Occurring Together: Independent Just multiply the probability of the first event by the second. For example, if the probability of event A is 2/9 and the probability of event B is 3/9 then the probability of both events happening at the same time is (2/9)*(3/9) = 6/81 = 2/27.

Q. How do you find the probability of independent and dependent events?

When we determine the probability of two independent events we multiply the probability of the first event by the probability of the second event. If one has three dice what is the probability of getting three 4s? When the outcome affects the second outcome, which is what we called dependent events.

Table of Contents

- Q. How do you find the probability of two independent events?

- Q. How do you find the probability of independent and dependent events?

- Q. How do you test for independence in probability?

- Q. How do you know if an independent is PA or B?

- Q. What is an example of a independent event?

- Q. Are A and B independent?

- Q. Can 2 events be independent and mutually exclusive?

- Q. What is P AUB if A and B are independent?

- Q. How do you know if two variables are independent?

- Q. Can two independent variables be correlated?

- Q. How do you know if something is statistically independent?

- Q. How do you know if something is independent or dependent?

- Q. What does it mean if two events are independent?

- Q. Which pair of events are dependent?

- Q. How do you know if an event is dependent?

- Q. What is an example of a dependent?

- Q. What defines a dependent?

- Q. Do you count yourself as a dependent?

- Q. Who counts as a dependent?

- Q. Can my boyfriend claim me as a dependent?

- Q. Can I claim my 25 year old son as a dependent?

- Q. What is the cut off age for claiming a dependent?

- Q. Should I claim my 19 year old as a dependent?

- Q. Can my boyfriend claim my child on his taxes 2020?

- Q. How much do you get back in taxes for a child 2020?

- Q. Can I claim my girlfriend’s child for child tax credit?

- Q. How do I stop someone from claiming my child on their taxes?

- Q. What happens if 2 parents claim the same child?

- Q. Can 2 parents claim the same child on taxes?

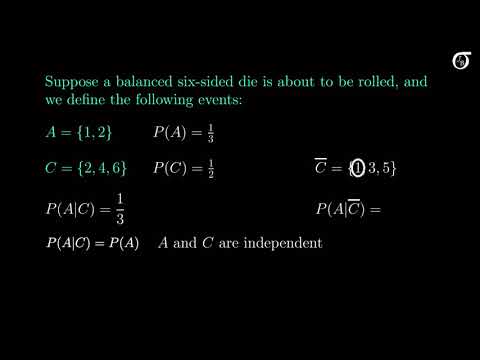

Q. How do you test for independence in probability?

Test for Independence To test whether two events A and B are independent, calculate P(A), P(B), and P(A ∩ B), and then check whether P(A ∩ B) equals P(A)P(B). If they are equal, A and B are independent; if not, they are dependent.

Q. How do you know if an independent is PA or B?

Formula for the probability of A and B (independent events): p(A and B) = p(A) * p(B). If the probability of one event doesn’t affect the other, you have an independent event. All you do is multiply the probability of one by the probability of another.

Q. What is an example of a independent event?

Independent events are those events whose occurrence is not dependent on any other event. For example, if we flip a coin in the air and get the outcome as Head, then again if we flip the coin but this time we get the outcome as Tail. In both cases, the occurrence of both events is independent of each other.

Q. Are A and B independent?

Events A and B are independent if: knowing whether A occured does not change the probability of B. Mathematically, can say in two equivalent ways: Important to distinguish independence from mutually exclusive which would say B ∩ A is empty (cannot happen).

Q. Can 2 events be independent and mutually exclusive?

Suppose two events have a non-zero chance of occurring. Then if the two events are mutually exclusive, they can not be independent. If two events are independent, they cannot be mutually exclusive.

Q. What is P AUB if A and B are independent?

If two events, A and B are mutually exclusive then, P(A U B) = P(A) + P(B). Since A and B are mutually exclusive, n(A ∩ B)=0 and so P(A ∩ B)=0.

Q. How do you know if two variables are independent?

You can tell if two random variables are independent by looking at their individual probabilities. If those probabilities don’t change when the events meet, then those variables are independent. Another way of saying this is that if the two variables are correlated, then they are not independent.

Q. Can two independent variables be correlated?

So, yes, samples from two independent variables can seem to be correlated, by chance.

Q. How do you know if something is statistically independent?

Events A and B are independent if the equation P(A∩B) = P(A) · P(B) holds true. You can use the equation to check if events are independent; multiply the probabilities of the two events together to see if they equal the probability of them both happening together.

Q. How do you know if something is independent or dependent?

To test whether two events A and B are independent, calculate P(A), P(B), and P(A ∩ B), and then check whether P(A ∩ B) equals P(A)P(B). If they are equal, A and B are independent; if not, they are dependent.

Q. What does it mean if two events are independent?

In probability, we say two events are independent if knowing one event occurred doesn’t change the probability of the other event. For example, the probability that a fair coin shows “heads” after being flipped is 1 / 2 1/2 1/2 .

Q. Which pair of events are dependent?

Two events are dependent if the outcome of the first event affects the outcome of the second event, so that the probability is changed. Example : Suppose we have 5 blue marbles and 5 red marbles in a bag.

Q. How do you know if an event is dependent?

Independent Events

- Two events A and B are said to be independent if the fact that one event has occurred does not affect the probability that the other event will occur.

- If whether or not one event occurs does affect the probability that the other event will occur, then the two events are said to be dependent.

Q. What is an example of a dependent?

The definition of dependent is relying on someone or something else, or a clause that cannot stand alone as a sentence. An example of dependent is a child to a parent. An example of dependent is “when the rain fell.” An example of a dependent is the child of a man.

Q. What defines a dependent?

a person who depends on or needs someone or something for aid, support, favor, etc. a child, spouse, parent, or certain other relative to whom one contributes all or a major amount of necessary financial support: She listed two dependents on her income-tax form.

Q. Do you count yourself as a dependent?

No, you claim yourself as the taxpayer. You are not technically your own dependent. When you file your return, you just indicate that you are not a qualifying dependent of someone else (unless you are), and you automatically get your personal exemption.

Q. Who counts as a dependent?

First and foremost, a dependent is someone you support: You must have provided at least half of the person’s total support for the year — food, shelter, clothing, etc. If your adult daughter, for example, lived with you but provided at least half of her own support, you probably can’t claim her as a dependent.

Q. Can my boyfriend claim me as a dependent?

You can claim a boyfriend or girlfriend as a dependent on your federal income taxes if that person meets the IRS definition of a “qualifying relative.”

Q. Can I claim my 25 year old son as a dependent?

To claim your child as your dependent, your child must meet either the qualifying child test or the qualifying relative test: To meet the qualifying child test, your child must be younger than you and either younger than 19 years old or be a “student” younger than 24 years old as of the end of the calendar year.

Q. What is the cut off age for claiming a dependent?

You can claim dependent children until they turn 19, unless they go to college, in which case they can be claimed until they turn 24. If your child is 24 years or older, they can still be claimed as a “qualifying relative” if they meet the qualifying relative test or they are permanently and totally disabled.

Q. Should I claim my 19 year old as a dependent?

Age Limitations If he turned 19 on or before Dec. 31 of the tax year, you can’t claim him unless he’s a student. However, if you’re preparing your taxes in April for the previous year, and if he turned 19 in January, he qualifies as your dependent. The guiding rule is how old he was on the last day of the year.

Q. Can my boyfriend claim my child on his taxes 2020?

A. Yes, if they meet all the IRS requirements for dependents. However, the IRS now says if the parent’s income is so low that he or she doesn’t have to file a tax return, then the boyfriend who lives with the mother and child all year long can claim the mother and the child as dependents.

Q. How much do you get back in taxes for a child 2020?

If you worked at any time during 2019, these are the income guidelines and credit amounts to claim the Earned Income Tax Credit and Child Tax Credit when you file your taxes in 2020. The Child Tax Credit is worth a maximum of $2,000 per qualifying child. Up to $1,400 is refundable.

Q. Can I claim my girlfriend’s child for child tax credit?

The children may qualify as dependents, but because they are not related, her children cannot be your qualifying child for the child tax credit, earned income credit or Head of Household filing status.

Q. How do I stop someone from claiming my child on their taxes?

If you found out that you claimed a dependent incorrectly on an IRS accepted tax return, you will need to file a tax amendment or form 1040-X and remove the dependent from your tax return. At any time, contact us here at eFile.com or call the IRS support line at 1-800-829-1040 and inform them of the situation.

Q. What happens if 2 parents claim the same child?

If you do not file a joint return with your child’s other parent, then only one of you can claim the child as a dependent. When both parents claim the child, the IRS will usually allow the claim for the parent that the child lived with the most during the year.

Q. Can 2 parents claim the same child on taxes?

Each parent may claim one of the children for all of the child-related benefits for which the parent otherwise qualifies. If a child lived with each parent the same amount of time during the year, the IRS allows the parent with the higher adjusted gross income (AGI) to claim the child.