Q. How do you put financial modeling on a resume?

If you have had some experience using a financial model in a previous role, by all means, include it in your resume – but don’t exaggerate because you may well be asked in the interview to back up and discuss in great detail the intricacies of how you created a particular model.

Q. How is equity value of a private company calculated?

It is calculated by multiplying a company’s share price by its number of shares outstanding. The number of weighted average shares outstanding is used in calculating metrics such as Earnings per Share (EPS) on a company’s financial statements.

Table of Contents

- Q. How do you put financial modeling on a resume?

- Q. How is equity value of a private company calculated?

- Q. Is financial Modelling a skill?

- Q. What skills do you need for modeling?

- Q. How do you calculate valuation of a company?

- Q. How do you evaluate a company’s value?

- Q. What to put on a private equity resume?

- Q. How are valuations used to value private companies?

- Q. What should I put on my resume as a valuation analyst?

- Q. How are private companies valued compared to public companies?

Q. Is financial Modelling a skill?

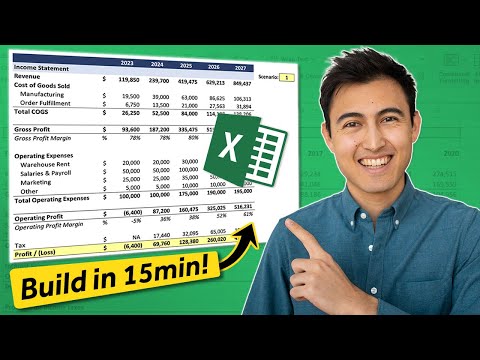

One of the least discussed, yet most important, financial modeling skills is having an eye for design and aesthetics. A good financial model is easy to follow and easy on the eyes – it should have clean formatting, beautiful charts and graphs, and look professional.

Q. What skills do you need for modeling?

Skills and knowledge

- the ability to work well with others.

- active listening skills.

- to be flexible and open to change.

- physical skills like movement, coordination, dexterity and grace.

- patience and the ability to remain calm in stressful situations.

- the ability to organise your time and workload.

- concentration skills.

Q. How do you calculate valuation of a company?

Methods Of Valuation Of A Company

- Net Asset Value or NAV= Fair Value of all the Assets of the Company – Sum of all the outstanding Liabilities of the Company.

- PE Ratio= Stock Price / Earnings per Share.

- PS Ratio= Stock Price / Net Annual Sales of the Company per share.

- PBV Ratio= Stock Price / Book Value of the stock.

Q. How do you evaluate a company’s value?

Determining Your Business’s Market Value

- Tally the value of assets. Add up the value of everything the business owns, including all equipment and inventory.

- Base it on revenue. How much does the business generate in annual sales?

- Use earnings multiples.

- Do a discounted cash-flow analysis.

- Go beyond financial formulas.

Q. What to put on a private equity resume?

Cater your experiences to what you might do as a private equity investment associate. Insert key details about your in-depth research, modeling experience, responsibilities within deal teams, and type of material you presented to your company or clients.

Q. How are valuations used to value private companies?

Investors can use valuations to help determine the worth of potential investments. They can do this by using data and information made public by a company. Regardless of who the valuation is for, it essentially describes the company’s worth.

Q. What should I put on my resume as a valuation analyst?

A well-written example resume in this field should mention skills like financial analysis expertise, detail orientation, computer proficiency, knowledge of relevant software, being able to deal with complexity, teamwork, and conflict resolution. Most Valuation Analysts hold a Bachelor’s Degree in a financial field.

Q. How are private companies valued compared to public companies?

These kind of circumstances are often hard to factor in, and generally require more reliability. Public company valuations, on the other hand, tend to be much more concrete because their values are based on actual data. As you can see, the valuation of a private firm is full of assumptions, best guess estimates, and industry averages.