Q. How does TCD work in GC?

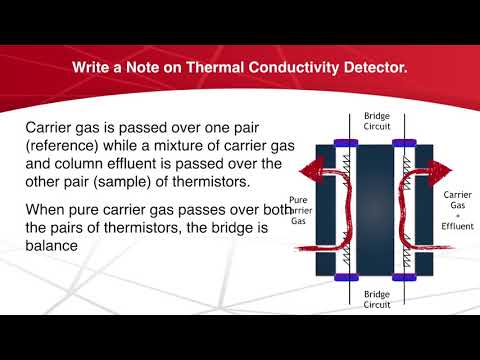

Thermal conductivity (TCD) is a commonly used detector in gas chromatography. TCD works by having two parallel tubes both containing gas and heating coils. Therefore, when an analyte elutes from the column, the thermal conductivity of the effluent is reduced and a detectable signal is produced.

Q. What does TCD detect?

The TCD is a universal, nondestructive, concentration-sensitive detector that responds to the difference in thermal conductivity of the carrier gas and the carrier gas containing sample. It is generally used to detect permanent gases, light hydrocarbons, and compounds that respond poorly to the FID.

Table of Contents

- Q. How does TCD work in GC?

- Q. What does TCD detect?

- Q. How does a GC column work?

- Q. What is the benefit of using TCD as a mode of detection in capillary GC?

- Q. What is difference between FID and TCD detector?

- Q. What is TCD for?

- Q. How is a TCD done?

- Q. What test shows blood flow to the brain?

- Q. What is a TCD banking?

- Q. What is dispensing cash for a living?

- Q. What is the difference between a cash recycler and a cash dispenser?

- Q. What is ATM recyclers?

- Q. How do cash recyclers work?

- Q. What is cash dispenser used for?

- Q. What is CRM machine?

- Q. What is CRM deposit?

- Q. What does CRM mean in banking?

- Q. What is the price of an ATM machine?

- Q. Is owning an ATM a good investment?

- Q. What is the best ATM machine to buy?

- Q. Is the ATM business dying?

- Q. Where is the best place to put an ATM machine?

- Q. How much money do you need to start an ATM business?

- Q. How much does it take to start an ATM business?

- Q. Can you steal an ATM machine?

- Q. Who fills money in ATM machines?

- Q. How do I start a Bitcoin ATM business?

- Q. Are Bitcoin ATMs legal?

- Q. What is the best Bitcoin ATM?

- Q. Can I buy Bitcoin at an ATM?

Q. How does a GC column work?

In the GC system, a sample is vaporized and injected into the head of the separation column packed with a finely divided solid or coated with a film of a liquid. Extensive research has led to improved columns for achieving better separation and resolution .

Q. What is the benefit of using TCD as a mode of detection in capillary GC?

The principle of detection is that analytes will generally have lower thermal conductivity than the carrier gas. It is rugged, but is not very selective compared to other detectors [12]. An advantage of the TCD is that it is non-destructive, making it useful for preparative separations.

Q. What is difference between FID and TCD detector?

The sensitivity of the GC-FID are 66 times higher than GC-TCD method. In addition, the GC-FID exhibits a wider linear range (0.161 -2.18%mol/mol) than the GC-TCD method (0.242 – 2.18%mol/mol).

Q. What is TCD for?

Transcranial doppler (TCD) ultrasound is a painless test that uses sound waves to detect medical problems that affect blood flow in your brain. It can detect stroke caused by blood clots, narrowed sections of blood vessels, vasospasm due to a subarachnoid hemorrhage, tiny blood clots and more.

Q. How is a TCD done?

The TCD is performed by a technologist trained in the specific type of neurovascular ultrasound. The patient will be awake and lying on a bed during the test. A small device called a transducer is connected to a laptop computer, which provides the technologist with data about the blood flow.

Q. What test shows blood flow to the brain?

Magnetic resonance imaging (MRI) uses computer-generated radio waves and a powerful magnetic field to produce detailed images of body tissues. Using different sequences of magnetic pulses, MRI can show anatomical images of the brain or spinal cord, measure blood flow, or reveal deposits of minerals such as iron.

Q. What is a TCD banking?

Teller Assist Units (TAU), also known as Automatic Teller Safes (ATS) or Teller Cash Dispensers (TCD), are devices used in retail banking for the disbursement of money at a bank teller wicket or a centralized area. Cash supplies are held in a vault or safe.

Q. What is dispensing cash for a living?

A cash dispenser is a machine built into the wall of a bank or other building, which allows people to take out money from their bank account using a special card.

Q. What is the difference between a cash recycler and a cash dispenser?

A Recycler solves different problems than a Dispenser. The biggest factor in choosing between the two is the type of cash flow they will be handling. In highly cash-negative locations, a Dispenser may be a better fit. Recyclers truly shine in locations where the cash in and out is roughly even.

Q. What is ATM recyclers?

When you deposit cash, a cash recycler counts the currency notes and displays the amount denomination wise and the total amount inserted in machine for deposit. To use the recycler for cash withdrawal, you can use an ATM or debit card like you do for any ATM transaction.

Q. How do cash recyclers work?

A cash recycler is a complex machine that handles a couple of simple, but important tasks—accepting and dispensing cash. It also stores money securely, keeps an accurate accounting of cash on hand, and automates the cash cycle. Generally, you’ll find them in banks, credit unions and back-office retail cash rooms.

Q. What is cash dispenser used for?

Q. What is CRM machine?

Cash Recycling Machines (CRM) are dual function machines which can take deposits, process the notes and then use that for withdrawals. This lowers operations cost but only if the machine works.

Q. What is CRM deposit?

The CRM is a self-service terminal that allows a customer to make both cash deposit and withdrawals. Working of the CRM. In a cash recycler or CRM, banknotes are placed into a feeder first when a person is depositing cash.

Q. What does CRM mean in banking?

Customer Relationship Management

Q. What is the price of an ATM machine?

Generally, ATM machines cost anywhere from around $1,000 up to $25,000 or more. A freestanding ATM machine costs approximately $3,500 to $7,000 and up. A built-in/through-the-wall ATM machine costs roughly $5,000 to $10,000 and up. A used/refurbished ATM machine can be purchased starting at about $500.

Q. Is owning an ATM a good investment?

Daniel said self-service or buying your own ATM is very profitable, and between 15 and 30 transactions a month yield a high return. “[It’s] a great secondary source of income that could equal between anywhere between $20,000 and $30,000 extra per year,” he said.

Q. What is the best ATM machine to buy?

Best ATM Machine Review

- Genmega 2500, Onyx. The Genmega 2500 is a is one of the top-ranked ATM machines designed for indoor placement.

- Hantle 1700.

- Nautilus Hyosung Halo.

- Triton Argo, Traverse.

- Diebold Nixdorf CS 2040, 280 and 5500.

- Nautilus Hyosung 2700.

- Genmega.

- Hantle.

Q. Is the ATM business dying?

ATMs and bank branches will be extinct by 2041 Recent research from Expert Market foresees the complete disappearance of all ATMs by 2037, while bank branches, at this rate, have just over 22 years left. The idea that we’re on the road to a completely cashless society isn’t new, but it is accurate.

Q. Where is the best place to put an ATM machine?

What Are the Best Locations to Put an ATM?

- Restaurant/Bar. Most people will pay for expensive meals at restaurants with a credit card so they don’t have much of a need for cash.

- Sports/Concert Arena.

- Gas Station/Convenience Store.

- Hotel.

Q. How much money do you need to start an ATM business?

What is the Startup Cost? The cost to purchase a new ATM is between $1,800 and $3,000 dollars. You may purchase a used ATM, but you must be absolutely sure that it is “3DES” or Triple DES compliant.

Q. How much does it take to start an ATM business?

To get started in the ATM business, you will need approximately $5,000 to purchase an ATM machine and load it with cash.

Q. Can you steal an ATM machine?

Cash machines have shrunk in size over the years, perhaps making them attractive targets, but they still weigh hundreds of pounds and are usually bolted to the floor at four different points. At one time, the most effective tools for stealing an A.T.M. were a truck and a chain.

Q. Who fills money in ATM machines?

Who loads the cash in the machine? As the owner of the ATM machine you are responsible for loading cash in the machine or having a 3rd party load cash into the machine. This cash is also paid back on a daily basis as customers pull cash from the ATM and deposited back into a bank account of your choosing.

Q. How do I start a Bitcoin ATM business?

Process Explained

- Buy Bitcoin ATM from chainbytes.com. Choose between Bitcoin ATM models and place the order by adding machines to your Cart and initiating order requests.

- Register AML/KYC requirements, (if in USA) with btmcompliance.com.

- Secure a steady supply of Bitcoins.

- Deploy Machine to Location.

- Service Cash.

Q. Are Bitcoin ATMs legal?

Mechanics of Bitcoin ATMs It is currently not legal for a customer using an ATM to purchase Bitcoin directly from an exchange. Instead, when a transaction is made the software sends the coins from the Operator’s hot wallet to the customer’s hot wallet.

Q. What is the best Bitcoin ATM?

Bitcoin ATM Providers

- Bitcoin Depot. Bitcoin Depot is the fastest growing multi-cryptocurrency ATM Network offering users the ability to buy and sell Bitcoin instantly at hundreds of locations across the United States.

- Bitnovo.

- BitVending.

- Cryptospace.

- General Bytes.

- Genesis.

- Lamassu.

- LocalCoin.

Q. Can I buy Bitcoin at an ATM?

Using Bitcoin ATMs you can buy bitcoins with cash ONLY. The average ATM charges a fee of 5-10%, but this is what people are willing to pay to buy bitcoins privately and with no verification. There are many Bitcoin ATM manufacturates, so each ATM is different. Some require verification, although most don’t.