Q. Is it better to be taxed as an S corp or C Corp?

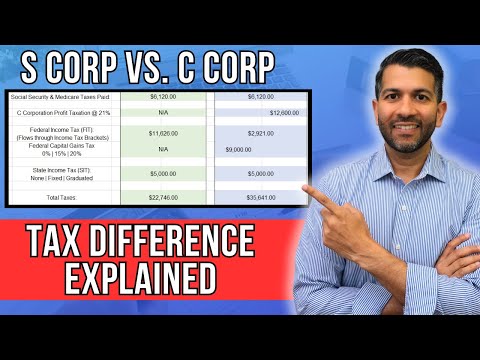

Single layer of taxation: The main advantage of the S corp over the C corp is that an S corp does not pay a corporate-level income tax. So any distribution of income to the shareholders is only taxed at the individual level.

Q. Are S and C corporations subject to corporate income tax?

S corps and C corps are not taxed the same From the standpoint of state business law, a corporation is a corporation. They are not subject to corporate income tax. Instead, they are treated similarly (but not identically) to partnerships for tax purposes.

Table of Contents

- Q. Is it better to be taxed as an S corp or C Corp?

- Q. Are S and C corporations subject to corporate income tax?

- Q. Are S corporations taxable?

- Q. What are the tax benefits of an S corporation?

- Q. Should my small business be an S corp or C Corp?

- Q. Are C corporations double taxed?

- Q. What is double taxation in C Corp?

- Q. What is C Corp tax return?

- Q. What is a C corporation tax?

Q. Are S corporations taxable?

Avoiding Double Taxation According to the IRS: Generally, an S corporation is exempt from federal income tax other than tax on certain capital gains and passive income. It is treated in the same way as a partnership, in that generally taxes are not paid at the corporate level.

Q. What are the tax benefits of an S corporation?

2. Pass-through taxation. The tax benefit for S corporations is that business income, as well as many tax deductions, credits, and losses, are passed through to the owners, rather than being taxed at the corporate level.

Q. Should my small business be an S corp or C Corp?

Who Should Choose an S Corp? An S Corp is the most tax-efficient option for many small business owners because it avoids double taxation. For a small business that can get the qualified business income deduction, an S Corps could be even more attractive.

Q. Are C corporations double taxed?

Double taxation occurs when a C-corp generates a profit for the year AND distributes that profit to shareholders in the form of a dividend. It’s called double taxation because the profits are taxed first at the corporate level and again by the recipient of dividends at the individual level.

Q. What is double taxation in C Corp?

DOUBLE TAXATION. Photo by: Aromant. Double taxation is a situation that affects C corporations when business profits are taxed at both the corporate and personal levels. The corporation must pay income tax at the corporate rate before any profits can be paid to shareholders.

Q. What is C Corp tax return?

A C Corp is a separate entity for income tax purposes. It files a corporation income tax return (IRS Form 1120), where it reports its profit or loss, and pays income taxes at the corporate income tax rate based on its profits.

Q. What is a C corporation tax?

A C corporation, under United States federal income tax law, refers to any corporation that is taxed separately from its owners. A C corporation is distinguished from an S corporation, which generally is not taxed separately.