Q. Is proportionate consolidation allowed under IFRS?

Proportional consolidation was a former accounting method under International Financial Reporting Standards (IFRS). On Jan. 1, 2013, the International Accounting Standards Board (IASB) abolished the use of proportional consolidation. Today both the IFRS and GAAP use the equity method.

Q. What is the proportionate consolidation method?

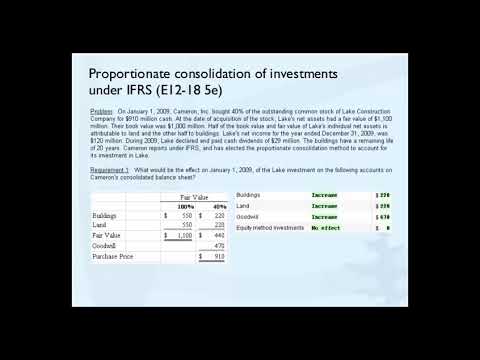

The proportional consolidation method of accounting records the assets and liabilities of a joint venture on a company’s balance sheet in proportion to the percentage of participation a company maintains in the venture.

Table of Contents

- Q. Is proportionate consolidation allowed under IFRS?

- Q. What is the proportionate consolidation method?

- Q. How do you consolidate an investment in a subsidiary?

- Q. What are jointly controlled operations?

- Q. What are the different types of joint ventures?

- Q. What is the equity method of accounting example?

- Q. What are relevant activities IFRS 10?

- Q. Which consolidation method is used for accounts of holding company and subsidiary company?

- Q. How to consolidate IFRS 10 consolidated financial statements?

- Q. How is proportionate consolidation reported on a financial statement?

- Q. What’s the difference between IAS 27 and IFRS 10?

- Q. What is the new control model under IFRS 10?

Q. How do you consolidate an investment in a subsidiary?

The consolidation method works by reporting the subsidiary’s balances in a combined statement along with the parent company’s balances, hence “consolidated”. Under the consolidation method, a parent company combines its own revenue with 100% of the revenue of the subsidiary.

Q. What are jointly controlled operations?

An example of a jointly controlled operation is when two or more venturers combine their operations, resources and expertise in order to manufacture, market and distribute, jointly, a particular product, such as an aircraft. Different parts of the manufacturing process are carried out by each of the venturers.

Q. What are the different types of joint ventures?

Types of Joint Ventures

- Project Joint Venture. This is the most common form of joint venture.

- Functional Joint Venture.

- Vertical Joint Venture.

- Horizontal Joint Venture.

Q. What is the equity method of accounting example?

The investor records their share of the investee’s earnings as revenue from investment on the income statement. For example, if a firm owns 25% of a company with a $1 million net income, the firm reports earnings from its investment of $250,000 under the equity method.

Q. What are relevant activities IFRS 10?

IFRS 10 defines ‘relevant activities’ as those activities of the investee that significantly affect the investee’s returns (IFRS 10 Appendix A).

Q. Which consolidation method is used for accounts of holding company and subsidiary company?

At the end of the year, a consolidation working paper eliminates intercompany transactions between parent and subsidiary. As of 2004, the acquisition method is the only allowable method that can be used to prepare consolidated financial statements for companies that combined after 2004.

Q. How to consolidate IFRS 10 consolidated financial statements?

I have described the consolidation procedures and their 3-step process in my previous article with the summary of IFRS 10 Consolidated financial statements, but let me repeat it here and follow these steps: Combine like items of assets, liabilities, equity, income, expenses and cash flows of the parent with those of its subsidiaries;

Q. How is proportionate consolidation reported on a financial statement?

Proportionate consolidation – A method of accounting whereby a venturer’s share of each of the assets, liabilities, revenue and expenses of a jointly controlled entity is combined line by line with similar items in the venturer’s financial statements or reported as separate line items in the venturer’s financial statements.

Q. What’s the difference between IAS 27 and IFRS 10?

IFRS 10 is a new standard which supersedes IAS 27 Consolidated and Separate Financial Statements (“IAS 27”) and SIC-12 Consolidation – Special Purpose Entities (“SIC- 12”). The primary goal behind the new standard was to come up with a single model for control which could be applied to all entities.

Q. What is the new control model under IFRS 10?

The new control model under IFRS 10 is based on the existence of three elements of control. When all of these three elements of control are present then an investor is considered to control an investee and consolidation is required.