Q. What are the singular definite articles in Spanish?

In Spanish, you have to choose between four definite articles: el, la, los and las.

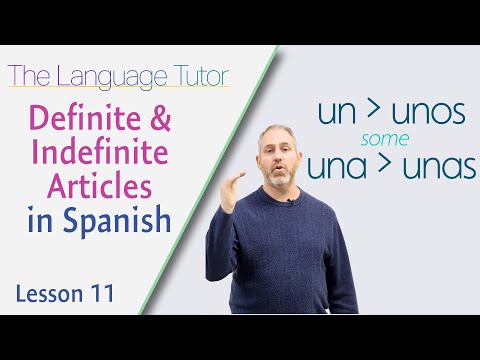

Q. What are definite and indefinite articles in Spanish?

An article is a word that is used with a noun (person, animal, thought or thing) to help define it. In English, the definite article is “the” and the indefinite articles are “a/an”, depending on the noun. The same concept applies in Spanish.

Table of Contents

- Q. What are the singular definite articles in Spanish?

- Q. What are definite and indefinite articles in Spanish?

- Q. Does patent have indefinite life?

- Q. Which intangible assets has an unlimited life?

- Q. What are the three major types of intangible assets?

- Q. What are the 5 intangible assets?

- Q. What is the best definition of a non-current asset?

- Q. What is the difference between current and noncurrent assets?

- Q. What is the best definition of a non-current assets CFI?

- Q. Is a vehicle a current asset?

- Q. What are current assets examples?

- Q. Is Bank a non-current asset?

- Q. Which is not current asset?

- Q. Is a bank loan considered a current liability?

- Q. Is bank loan a liability or asset?

- Q. Is loan a debit or credit?

- Q. Is money in the bank considered an asset?

- Q. What is asset and liability?

Q. Does patent have indefinite life?

Some examples of indefinite-life intangibles are goodwill, trademarks, and perpetual franchises. Indefinite-life tangibles are not amortized because there is no foreseeable limit to the cash flows generated by those intangible assets. They include trade secrets, copyrights, patents, and trademarks.

Q. Which intangible assets has an unlimited life?

As the term suggest, limited life intangible assets have a time-limited life or value. Copyrights and patents are examples because they expire. Indefinite or unlimited life intangible assets – goodwill or reputation, for example – don’t have a definite end date.

Q. What are the three major types of intangible assets?

These are assets such as intellectual property, patents, copyrights, trademarks, and trade names.

Q. What are the 5 intangible assets?

Examples of intangible assets include goodwill, brand recognition, copyrights, patents, trademarks, trade names, and customer lists. You can divide intangible assets into two categories: intellectual property and goodwill.

Q. What is the best definition of a non-current asset?

Noncurrent assets are a company’s long-term investments that are not easily converted to cash or are not expected to become cash within an accounting year. Examples of noncurrent assets include investments, intellectual property, real estate, and equipment.

Q. What is the difference between current and noncurrent assets?

Current assets are assets that are expected to be converted to cash within a year. Noncurrent assets are those that are considered long-term, where their full value won’t be recognized until at least a year. Noncurrent liabilities are financial obligations that are not due within a year, such as long-term debt.

Q. What is the best definition of a non-current assets CFI?

Non-current assets are assets whose benefits will be realized over more than one year and cannot easily be converted into cash. The assets are recorded on the balance sheet at acquisition cost, and they include property, plant and equipment, intellectual property, intangible assets.

Q. Is a vehicle a current asset?

A vehicle is also a fixed and noncurrent asset if its use includes commuting or hauling company products. However, property, plant, and equipment costs are generally reported on financial statements as a net of accumulated depreciation.

Q. What are current assets examples?

Current assets include cash, cash equivalents, accounts receivable, stock inventory, marketable securities, pre-paid liabilities, and other liquid assets. Current assets are important to businesses because they can be used to fund day-to-day business operations and to pay for the ongoing operating expenses.

Q. Is Bank a non-current asset?

A current asset is any asset that is expected to provide an economic benefit for or within one year. Funds held in bank accounts for less than one year may be considered current assets. Funds held in accounts for longer than a year are considered non-current assets.

Q. Which is not current asset?

Non-current assets are assets which represent a longer-term investment and cannot be converted into cash quickly. They are likely to be held by a company for more than a year. Examples of non-current assets include land, property, investments in other companies, machinery and equipment.

Q. Is a bank loan considered a current liability?

The most common current liabilities found on the balance sheet include accounts payable, short-term debt such as bank loans or commercial paper issued to fund operations, dividends payable.

Q. Is bank loan a liability or asset?

However, for a bank, a deposit is a liability on its balance sheet whereas loans are assets because the bank pays depositors interest, but earns interest income from loans.

Q. Is loan a debit or credit?

What are debits and credits?

| Account Type | Increases Balance | Decreases Balance |

|---|---|---|

| Liabilities: Liabilities include things you owe such as accounts payable, notes payable, and bank loans | Credit | Debit |

| Revenue: Revenue is the money your business is paid for the sale of products and services | Credit | Debit |

Q. Is money in the bank considered an asset?

Bank funds. The money you have stashed away in your checking account or savings account can be considered a solid asset. You can easily access these funds which makes them especially valuable.

Q. What is asset and liability?

Assets are the items your company owns that can provide future economic benefit. Liabilities are what you owe other parties. In short, assets put money in your pocket, and liabilities take money out!