Q. What does it mean to pay by Cheque?

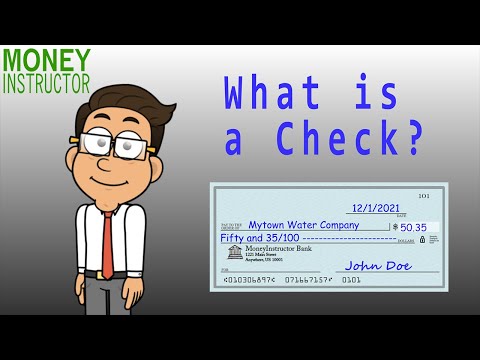

A cheque, or check (American English; see spelling differences), is a document that orders a bank to pay a specific amount of money from a person’s account to the person in whose name the cheque has been issued. Since then cheque usage has fallen, being partly replaced by electronic payment systems.

Q. Is paying with a check considered cash?

Cash includes the coins and currency of the United States and a foreign country. Cash may also include cashier’s checks, bank drafts, traveler’s checks, and money orders with a face value of $10,000 or less, if the business receives the instrument in: A designated reporting transaction (as defined below), or.

Table of Contents

- Q. What does it mean to pay by Cheque?

- Q. Is paying with a check considered cash?

- Q. Can I pay with or by?

- Q. What does pay by cash mean?

- Q. Is paying by cash illegal?

- Q. How do I prove I paid someone in cash?

- Q. How much can I pay an employee without paying taxes?

- Q. What happens if I pay my employee cash?

- Q. How much money can I make babysitting without paying taxes?

- Q. Is it illegal to babysit for cash?

- Q. How much can I pay someone without a 1099?

- Q. How do I declare babysitting income?

- Q. Is Babysitting considered self employment?

- Q. Can I report income without a 1099?

- Q. Can I pay my mom for babysitting?

- Q. Can I hire my mom as a nanny?

- Q. Should Grandma get paid for babysitting?

- Q. Can I claim child care if I pay cash?

- Q. How much money can you make before having to file taxes?

- Q. Do grandparents get paid for looking after their grandchildren?

- Q. What’s better daycare or grandparents?

- Q. How much should you pay a relative to babysit?

Q. Can I pay with or by?

By is used to talk about the method, or how we got the result. Whereas with is used to talk about the tool used to get the result. That said, our result is the payment, and we can get there by either using a tool or a means.

Q. What does pay by cash mean?

Pay in cash : you are referring to pay something in the form of cash (money) Pay by cash: you are referring to pay something by payment method (by credit card, by visa card, by cash)

Q. Is paying by cash illegal?

There is no law against paying someone in cash, but those who do receive cash payments are under a legal obligation to disclose their earnings to HMRC and say whether they are liable for income tax or VAT.

Q. How do I prove I paid someone in cash?

Every case is different, but here are some potential ways to prove you paid for something with cash:

- Save Receipts. This seems like a no-brainer… and it is.

- Cashier’s Checks or Money Orders.

- Bank Statements and ATM Receipts.

- Find a Witness.

Q. How much can I pay an employee without paying taxes?

For a single adult under 65 the threshold limit is $12,000. If the taxpayer earned no more than that, no taxes are due.

Q. What happens if I pay my employee cash?

Paying employees cash under the table is illegal, and can cost you heavy fines and/or prison time. The Internal Revenue Service (IRS) lists paying employees cash under the table as one of the top ways employers avoid paying taxes.

Q. How much money can I make babysitting without paying taxes?

According to the IRS, babysitters do need to report their income when filing their taxes if they earned $400 or more (net income) for their work. This income is basically from self-employment so you don’t have to issue Form 1099 if you pay a babysitter unless they earned $600 or more.

Q. Is it illegal to babysit for cash?

Generally yes, but it will depend on where you live and how much income you earn from babysitting each year. Money earned from babysitting is considered taxable income and you should be declaring it on your taxes. Even if you get paid in cash.

Q. How much can I pay someone without a 1099?

You add up all payments made to a payee during the year, and if the amount is $600 or more for the year, you must issue a 1099 for that payee. If the amount you paid the worker totals less than $600 for the tax year, then you are not required to issue a 1099 form.

Q. How do I declare babysitting income?

Any self-employed income you receive from babysitting – in excess of a net $400 per tax year – must be reported at tax time on Form 1040, Schedule C or Schedule C-EZ. While you aren’t obligated to file a return with the IRS if you net less than $400 in a given tax year, it is still a good idea to do so.

Q. Is Babysitting considered self employment?

Babysitting is generally considered self-employment because you’re not being treated like an employee. You have more control over your own schedule in terms of what gigs you decide to take on, and you work on your own terms. Nannies, however, are generally considered to be employees of the family.

Q. Can I report income without a 1099?

You don’t have to file a 1099 with your income tax return, so if you don’t have the form, that’s not really a problem as long as you report the income and pay the proper amount of tax.

Q. Can I pay my mom for babysitting?

You can include amounts you pay your mom to babysit so you can work or go to school, but you must have some earned income during the year for qualified expenses to count for the credit.

Q. Can I hire my mom as a nanny?

Usually you must withhold Social Security and Medicare taxes for household employees. your parent is exempt from social security and medicare withholding. This makes the whole “hiring your parent” thing a lot easier.

Q. Should Grandma get paid for babysitting?

While you hope the grandparents won’t expect to be paid for occasional babysitting, it is reasonable for them to be paid if they provide ongoing or full-time care for the kids. After all, babysitting is a job, and it requires them to have certain responsibilities and keep certain hours.

Q. Can I claim child care if I pay cash?

Limitation Considerations. The IRS allows taxpayers to pay their child care providers using cash or by check. However, you must provide your child care provider’s employer identification number or Social Security number on your tax return.

Q. How much money can you make before having to file taxes?

Single: If you are single and under the age of 65, the minimum amount of annual gross income you can make that requires filing a tax return is $12,200. If you’re 65 or older and plan on filing single, that minimum goes up to $13,850.

Q. Do grandparents get paid for looking after their grandchildren?

You can unsubscribe at any time. Grandparents can get paid for helping to occupy their grandchildren online or on the phone during the coronavirus pandemic. In the UK, thousands of grandparents claim credits worth around £260 a year for helping parents with childcare.

Q. What’s better daycare or grandparents?

There are very good reasons why a daycare is a better option. It is good for their social skills and development. These are all very important skills that they won’t get in grandparent’s care. But both options will provide a nice balance for the baby, and would not be an obligation to grandparents for daily care.

Q. How much should you pay a relative to babysit?

Going Rates by Area Care.com provides a babysitter pay rate calculator to find out the going rate for sitters in your area. According to the Care.com 2019 Babysitter Survey, the average babysitting rate in 2018 was about $16.25 per hour.