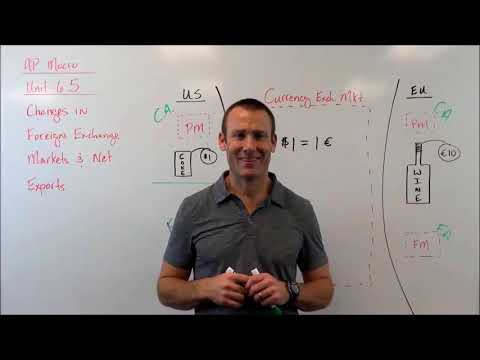

The depreciation of the domestic currency causes exports to rise and imports to fall. Because net exports are one component of aggregate demand, this increase in net exports (exports minus imports) causes an increase in aggregate demand at each price level.

Q. What would the change in the exchange rate make happen to US net exports and US aggregate demand?

What would the change in the exchange rate make happen to U.S. net exports and U.S. aggregate demand? Net exports would fall which by itself would decrease U.S. aggregate demand.

Table of Contents

- Q. What would the change in the exchange rate make happen to US net exports and US aggregate demand?

- Q. What will a rise in net exports do quizlet?

- Q. When the US dollar appreciates is more expensive for foreigners to purchase US goods?

- Q. What happens to ad when dollar depreciates?

- Q. Why are trade deficits bad for the economy?

Q. What will a rise in net exports do quizlet?

What will a rise in net exports do? Shift the aggregate demand curve to the right. The ___ is when a higher price level reduces the purchasing power of the public’s accumulated savings balances. output prices are flexible but input prices are fixed or highly inflexible.

Q. When the US dollar appreciates is more expensive for foreigners to purchase US goods?

Export costs rise: If the U.S. dollar appreciates, foreigners will find American goods more expensive because they have to spend more for those goods in USD. That means that with the higher price, the number of U.S. goods being exported will likely drop.

Q. What happens to ad when dollar depreciates?

When the dollar depreciates against foreign currencies, exports should increase and imports should decrease. This is because US products get cheaper for foreigners, and their products get to be more expensive for the US. In such a case, there gets to be increased demand for American products.

Q. Why are trade deficits bad for the economy?

Trade deficits are the difference between how much a country imports and how much it exports. When done right, they can let trading partners specialize in their strengths and create wealth for all consumers. Gone wrong, they can harm labor markets and create problems of savings and investment.