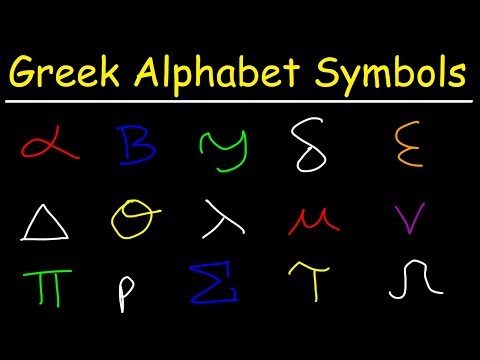

Q. What Greek letters are used in math?

Greek letters used in mathematics, science, and engineering

| Αα | Alpha | Nu |

|---|---|---|

| Ββ | Beta | Xi |

| Γγ | Gamma | Omicron |

| Δδ | Delta | Pi |

| Εε | Epsilon | Rho |

Q. Why is Greek alphabet used in math?

Because European mathematics is very heavily rooted in the mathematics of ancient Greece, and due to the need for many symbols to represent constants, variables, functions and other mathematical objects, mathematicians frequently use letters from the Greek alphabet in their work.

Table of Contents

- Q. What Greek letters are used in math?

- Q. Why is Greek alphabet used in math?

- Q. What letters are used in math?

- Q. What is the Greek letter used in statistical calculations?

- Q. What is Max in Excel?

- Q. What is the formula to calculate sales?

- Q. How do you calculate monthly sales?

- Q. How do you calculate total cost?

- Q. What is the formula for unit cost?

- Q. How do you calculate total cost of ownership?

- Q. Is rent a fixed cost?

- Q. What are the 4 types of cost?

- Q. Is rent a fixed or variable cost?

- Q. What is mixed Cost example?

- Q. What is the mixed cost formula?

- Q. What is the mixed cost equation?

- Q. Is Depreciation a mixed cost?

- Q. Is salary a mixed cost?

- Q. How do mixed costs behave?

- Q. How is depreciation fixed cost calculated?

- Q. What is depreciation formula?

- Q. What is fixed cost example?

- Q. What is the depreciation expense formula?

Q. What letters are used in math?

Latin and Greek letters are used in mathematics, science, engineering, and other areas where mathematical notation is used as symbols for constants, special functions, and also conventionally for variables representing certain quantities. while extensive are denoted with capital letters.

Q. What is the Greek letter used in statistical calculations?

Σ

Q. What is Max in Excel?

The Excel MAX function returns the largest numeric value in a range of values. The MAX function ignores empty cells, the logical values TRUE and FALSE, and text values. Get the largest value. The largest value in the array. =MAX (number1, [number2].)

Q. What is the formula to calculate sales?

Gross sales are calculated simply as the units sold multiplied by the sales price per unit….Net Sales vs. Gross Sales.

| Net Sales | Gross Sales | |

|---|---|---|

| Formula | Gross Sales – Deductions | Units Sold x Sales Price |

Q. How do you calculate monthly sales?

To calculate the average sales over your chosen period, you can simply find the total value of all sales orders in the chosen timeframe and divide by the intervals. For example, you can calculate average sales per month by taking the value of sales over a year and dividing by 12 (the number of months in the year).

Q. How do you calculate total cost?

The formula for calculating average total cost is:

- (Total fixed costs + total variable costs) / number of units produced = average total cost.

- (Total fixed costs + total variable costs)

- New cost – old cost = change in cost.

- New quantity – old quantity = change in quantity.

Q. What is the formula for unit cost?

For a typical manufacturing environment, however, the unit cost formula is: Unit Cost = Variable Costs + Fixed Costs / Total Units Produced.

Q. How do you calculate total cost of ownership?

When looking at the total cost of ownership, be sure to calculate energy costs, maintenance, and repair fees….I + M – R = TCO.

| Pump A | Pump B | |

|---|---|---|

| Initial cost | $10,000 | $20,000 |

| + Maintenance | $5,000 | $2,000 |

| – Remaining value | $2,000 | $10,000 |

| = TCO | $13,000 | $12,000 |

Q. Is rent a fixed cost?

Fixed costs remain the same regardless of whether goods or services are produced or not. The most common examples of fixed costs include lease and rent payments, utilities, insurance, certain salaries, and interest payments.

Q. What are the 4 types of cost?

Direct, indirect, fixed, and variable are the 4 main kinds of cost. In addition to this, you might also want to look into operating costs, opportunity costs, sunk costs, and controllable costs.

Q. Is rent a fixed or variable cost?

Fixed expenses or costs are those that do not fluctuate with changes in production level or sales volume. They include such expenses as rent, insurance, dues and subscriptions, equipment leases, payments on loans, depreciation, management salaries, and advertising.

Q. What is mixed Cost example?

Mixed costs are costs that contain a portion of both fixed and variable costs. Common examples include utilities and even your cell phone!

Q. What is the mixed cost formula?

A mixed cost can be expressed using the below algebraic formula. y = a + bx, where: a is fixed cost during the period = $ 100,000. b is variable rate calculated per unit of the activity = $ 10 per unit. x is number of the units of the activity = 50,000 units.

Q. What is the mixed cost equation?

A mixed cost is expressed by the algebraic formula y = a + bx, where: y is the total cost. a is the fixed cost per period. b is the variable rate per unit of activity. x is the number of units of activity.

Q. Is Depreciation a mixed cost?

Depreciation is a fixed cost, because it recurs in the same amount per period throughout the useful life of an asset. Depreciation cannot be considered a variable cost, since it does not vary with activity volume.

Q. Is salary a mixed cost?

Mixed expenses consist of a constant or fixed portion and a variable portion. For example, sales salaries would be a mixed expense if each sales person’s compensation is $2,000 per month plus 3% of the sales generated by the employee. Automobile expense is a mixed expense in relationship to miles driven.

Q. How do mixed costs behave?

Mixed Costs However, there is a third type of cost that behaves differently in that both total and per unit costs change with changes in activity. This is a mixed cost because it has a fixed component of $10,000 per month and a variable component of $7 per unit.

Q. How is depreciation fixed cost calculated?

How it works: You divide the cost of an asset, minus its salvage value, over its useful life. That determines how much depreciation you deduct each year.

Q. What is depreciation formula?

To calculate depreciation subtract the asset’s salvage value from its cost to determine the amount that can be depreciated. Divide this amount by the number of years in the asset’s useful lifespan. Divide by 12 to tell you the monthly depreciation for the asset.

Q. What is fixed cost example?

Fixed costs are usually negotiated for a specified time period and do not change with production levels. Examples of fixed costs include rental lease payments, salaries, insurance, property taxes, interest expenses, depreciation, and potentially some utilities.

Q. What is the depreciation expense formula?

The straight-line formula used to calculate depreciation expense is: (asset’s historical cost – the asset’s estimated salvage value ) / the asset’s useful life. The journal entry for this transaction is a debit to Depreciation Expense for USD 1,000 and a credit to Accumulated Depreciation for USD 1,000.