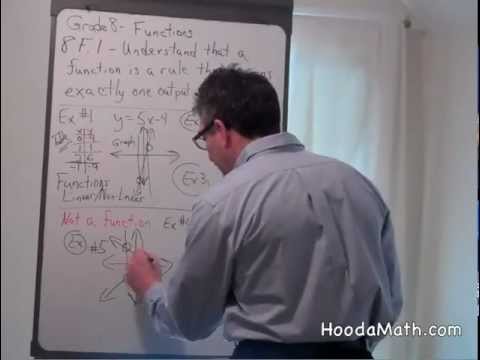

Q. What is a relationship which assigns exactly one output value for each input value?

A function is a relation in which each possible input value leads to exactly one output value. We say “the output is a function of the input.” The input values make up the domain, and the output values make up the range.

Q. What do you call a relation with exactly one output per input?

A function is a relation (such that for each input, there is exactly one output) between sets.

Table of Contents

- Q. What is a relationship which assigns exactly one output value for each input value?

- Q. What do you call a relation with exactly one output per input?

- Q. What is another name to represent the input values of a function?

- Q. What is the plural of input?

- Q. What is the plural of output?

- Q. What does imputed mean?

- Q. Is putted a word?

- Q. What does imputed mean in law?

- Q. What does imputed mean on my paycheck?

- Q. Is imputed income good or bad?

- Q. How is imputed tax calculated?

- Q. What is DP imputed income?

- Q. Do you pay taxes on imputed income?

- Q. How does a judge impute income?

- Q. Can you write off imputed income?

- Q. Are gift cards imputed income?

- Q. Is imputed income taxed higher?

- Q. How can imputed income be avoided?

- Q. What does GTL imputed mean?

- Q. What is STD imputed income?

- Q. What is imputed income in a divorce?

Q. What is another name to represent the input values of a function?

Remember, in a function each input has only one output. There is a name for the set of input values and another name for the set of output values for a function. The set of input values is called the domain of the function. And the set of output values is called the range of the function.

Q. What is the plural of input?

1 input /ˈɪnˌpʊt/ noun. plural inputs. 1 input. /ˈɪnˌpʊt/ plural inputs.

Q. What is the plural of output?

Noun. output (countable and uncountable, plural outputs) (economics) Production; quantity produced, created, or completed.

Q. What does imputed mean?

impute • /im-PYOOT/ • verb. 1 : to lay the responsibility or blame for often falsely or unjustly 2 : to credit to a person or a cause.

Q. Is putted a word?

Simple past tense and past participle of putt.

Q. What does imputed mean in law?

1) To attach or ascribe. 2) To place responsibility or blame on one person for acts of another person because of a particular relationship, such as mother to child, guardian to ward, employer to employee, or business associates.

Q. What does imputed mean on my paycheck?

Imputed income is adding value to cash or non-cash employee compensation to accurately withhold employment and income taxes. Basically, imputed income is the value of any benefits or services provided to an employee. Employers must add imputed income to an employee’s gross wages to accurately withhold employment taxes.

Q. Is imputed income good or bad?

This answer is correct. The imputed income could also affect your partner’s net paycheck, depending on what tax withholding elections are in effect (W-4). Imputed income would go away if/when you get married. Imputed income is the money you will save by not having to buy insurance.

Q. How is imputed tax calculated?

One simple way to do the calculation is to determine the difference between your company’s cost of an employee-only monthly premium and the cost of an employee-plus-one monthly premium. Multiply that number by 12 and you will get your total.

Q. What is DP imputed income?

Imputed income is defined as the value of the domestic partner coverage minus the after-tax amount contributed toward the coverage.

Q. Do you pay taxes on imputed income?

Unless specifically exempt, imputed income is added to the employee’s gross (taxable) income. But it is treated as income so employers need to include it in the employee’s form W-2 for tax purposes. Imputed income is subject to Social Security and Medicare tax but typically not federal income tax.

Q. How does a judge impute income?

Imputing Income. If a parent has attempted to change their income to avoid support, a judge may “impute” income. This is income that is attributed or credited to a parent even though the parent is not actually earning that amount.

Q. Can you write off imputed income?

The additional $175 of imputed income is not actually money that you receive. It is reported to the IRS as taxable income because it is a benefit that is not eligible for a tax deduction. But it doesn’t change your cash wages.

Q. Are gift cards imputed income?

Yes, gift cards are taxable. According to the IRS, gift cards for employees are considered cash equivalent items. Like cash, you must include gift cards in an employee’s taxable income—regardless of how little the gift card value is.

Q. Is imputed income taxed higher?

This calculated fringe benefit is known as imputed income. This fringe benefit will increase your taxable income. Therefore, your federal, State, Social Security and Medicare taxes may increase and your net pay will decrease. You are not paying taxes on the same monies twice.

Q. How can imputed income be avoided?

When it comes to your CBP, avoiding imputed income is quite simple. Use the funds within the permitted time period. If you use up all of your funds within that time, it will prevent the funds from becoming imputed.

Q. What does GTL imputed mean?

Imputed income for group-term life

Q. What is STD imputed income?

* Imputed income is the term the IRS applies to the value of any benefit or service that should be considered income for the purposes of calculating your federal, state and local taxes. On your paycheck, the STD Benefit in the “Imputed Income” section is the taxable amount that reflects the value of the STD benefit.

Q. What is imputed income in a divorce?

Imputation of income in the context of an alimony or child support case refers to the court prescribing an income to one party based on his or her earning capacity (i.e. what they are capable of earning under the given circumstances) even though they aren’t working or they are underemployed.