Q. What is an APR finance charge?

9, 2021 – First published on Dec. 15, 2020. A finance charge definition is the interest you’ll pay on a debt, and it’s generally used in the context of credit card debt. A finance charge is calculated using your annual percentage rate, or APR, the amount of money you owe, and the time period.

Q. What is the meaning of finance charges?

Finance charges are a form of compensation to the lender for providing the funds, or extending credit, to a borrower. These charges can include one-time fees, such as an origination fee on a loan, or interest payments, which can amortize on a monthly or daily basis.

Table of Contents

- Q. What is an APR finance charge?

- Q. What is the meaning of finance charges?

- Q. Is a tax service fee a finance charge?

- Q. Is finance charge the same as interest rate?

- Q. What is an example of a finance charge?

- Q. What’s the difference between APR and finance charges?

- Q. What is a normal finance charge?

- Q. What is excluded from the finance charge?

- Q. Why is my finance charge so high?

- Q. How is a finance charge calculated?

- Q. Do I have to pay the finance charge on a loan?

- Q. How do you calculate a finance charge?

- Q. What is a finance charge on a credit card?

- Q. What does Rad stand for in aged care?

- Q. How much money do you have to pay for Rad and DAP?

- Q. What’s the maximum income to be eligible for the Rad?

Q. Is a tax service fee a finance charge?

A creditor financing the sale of property or services may compare charges with those payable in a similar cash transaction by the seller of the property or service. For example, the following items are not finance charges: A. Taxes, license fees, or registration fees paid by both cash and credit customers.

Q. Is finance charge the same as interest rate?

When it comes to personal finance matters, such as for a payday loan or buying a used car on credit, the finance charge refers to a set amount of money that you are charged for being given the loan. By contrast, when you are charged an interest rate you will pay less to borrow the money if you pay it off quickly.

Q. What is an example of a finance charge?

Finance charges may be levied as a percentage amount of any outstanding loan balance. These types of finance charges include things such as annual fees for credit cards, account maintenance fees, late fees charged for making loan or credit card payments past the due date, and account transaction fees.

Q. What’s the difference between APR and finance charges?

Finance charges include all charges associated with the loan, including interest and commitment fees. The annual percentage rate is the amount of interest that compounds daily.

Q. What is a normal finance charge?

A typical finance charge, for example, might be 1½ percent interest per month. However, finance charges can be as low as 1 percent or as high as 2 or 3 percent monthly. The amounts can vary based on factors such as customer size, customer relationship and payment history.

Q. What is excluded from the finance charge?

Charges Excluded from Finance Charge: 1) application fees charged to all applicants, regardless of credit approval; 2) charges for late payments, exceeding credit limits, or for delinquency or default; 3) fees charged for participation in a credit plan; 4) seller’s points; 5) real estate-related fees: a) title …

Q. Why is my finance charge so high?

Every loan term is different, depending on factors like your credit score and the amount you’re requesting to borrow. Smaller loans typically have very high monthly finance charges, because the bank makes money off of these charges and they know that a smaller loan will be paid off more quickly.

Q. How is a finance charge calculated?

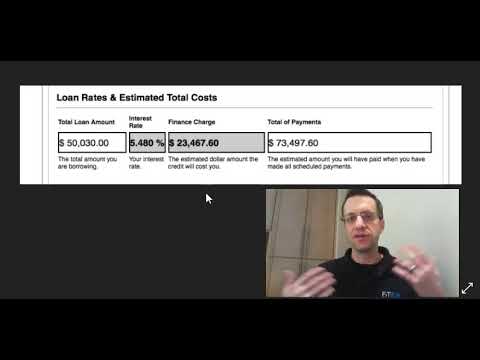

A common way of calculating a finance charge on a credit card is to multiply the average daily balance by the annual percentage rate (APR) and the days in your billing cycle. The product is then divided by 365 . Mortgages also carry finance charges. Anything above the principal on the loan is a finance charge.

Q. Do I have to pay the finance charge on a loan?

A finance charge is usually added to the amount you borrow, unless you pay the full amount back within the grace period . In some instances, such as credit card cash advances, you need to pay a finance charge even if you pay the amount in full by the due date.

Q. How do you calculate a finance charge?

To sum up, the finance charge formula is the following: Finance charge = Carried unpaid balance * Annual Percentage Rate (APR) / 365 * Number of Days in Billing Cycle .

Q. What is a finance charge on a credit card?

The finance charge is the cost of consumer credit as a dollar amount. It includes any charge payable directly or indirectly by the consumer and imposed directly or indirectly by the creditor as an incident to or a condition of the extension of credit. It does not include any charge of a type payable in a comparable cash transaction. 1.

Q. What does Rad stand for in aged care?

The Refundable Accommodation Deposit (RAD), is a standard room price set by the respective aged care facility. The Daily Accommodation Payment (DAP) is the RAD equivalent paid periodically.

Q. How much money do you have to pay for Rad and DAP?

That sum is subject to quarterly change, but currently it means a resident must be left with at least $44,000 if they choose to pay for their accommodation in full. The introduction of the RAD and DAP is predicted to increase marketplace competition and broaden consumer choice.

Q. What’s the maximum income to be eligible for the Rad?

If a resident is eligible for the maximum accommodation supplement, which currently means they have an income below $22,701 and assets below $40,500, then the implication of the RAD or DAP does not apply.