The general ledger contains the detailed transactions comprising all accounts, while the trial balance only contains the ending balance in each of those accounts. The trial balance has a much more limited use, where the totals of all debits and credits are compared to verify that the books are in balance.

Q. What is the journal entry of started business with cash?

Journal entry for started business with cash The cash a/c is debited as it is an asset for the business and the capital a/c is credited as it is a liability for the business according to the business entity concept.

Table of Contents

- Q. What is the journal entry of started business with cash?

- Q. How do you prepare journal entries?

- Q. How do you prepare a trial balance from a journal entry?

- Q. What are the methods of preparing trial balance?

- Q. How do you prepare a trial balance example?

- Q. What are the rules of trial balance?

- Q. What is the rule of journal entry?

- Q. Is it true that trial balance totals should agree?

- Q. What is not included in trial balance?

- Q. What are the three types of trial balances?

- Q. Does a trial balance include all accounts?

- Q. Should trial balance and balance sheet match?

- Q. Is depreciation shown in trial balance?

- Q. How do I know if my trial balance is correct?

- Q. Is there any difference between balance sheet and trial balance?

- Q. What are the 3 golden rules of accounting?

- Q. What is trial balance example?

Q. How do you prepare journal entries?

4.4 Preparing Journal Entries

- Describe the purpose and structure of a journal entry.

- Identify the purpose of a journal.

- Define “trial balance” and indicate the source of its monetary balances.

- Prepare journal entries to record the effect of acquiring inventory, paying salary, borrowing money, and selling merchandise.

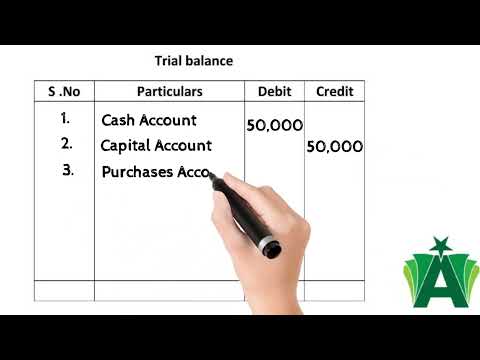

Q. How do you prepare a trial balance from a journal entry?

Steps in Preparation of Trial Balance

- Calculate the Balances of Each of the Ledger Accounts.

- Record Debit or Credit Balances in Trial Balance.

- Calculate Total of The Debit Column.

- Calculate Total of The Credit Column.

- Check if Debit is Equal To Credit.

Q. What are the methods of preparing trial balance?

Methods To Prepare Trial Balance

- Total Method or Gross Trial Balance.

- Balance Method or Net Trial Balance.

- Compound Method.

Q. How do you prepare a trial balance example?

The four basic steps to developing a trial balance are:

- Prepare a worksheet with three columns.

- Fill in all the account titles and record their balances in the appropriate debit or credit columns.

- Total the debit and credit columns.

- Compare the column totals.

Q. What are the rules of trial balance?

RULES OF TRIAL BALANCE

- All assets must be put on the debit side.

- All liabilities must be put on the credit side.

- All income or gain must be recorded on the credit side.

- All expenses must be recorded on the debit side.

Q. What is the rule of journal entry?

When a business transaction requires a journal entry, we must follow these rules: The entry must have at least 2 accounts with 1 DEBIT amount and at least 1 CREDIT amount. The DEBITS are listed first and then the CREDITS. The DEBIT amounts will always equal the CREDIT amounts.

Q. Is it true that trial balance totals should agree?

Yes, it is true that the trial balance totals should agree.

Q. What is not included in trial balance?

You should not include income statement accounts such as the revenue and operating expense accounts. Other accounts such as tax accounts, interest and donations do not belong on a post-closing trial balance report.

Q. What are the three types of trial balances?

There are three types of trial balances: the unadjusted trial balance, the adjusted trial balance and the post- closing trial balance. All three have exactly the same format. The unadjusted trial balance is prepared before adjusting journal entries are completed.

Q. Does a trial balance include all accounts?

What does a trial balance include? A trial balance includes a list of all general ledger account totals. Each account should include an account number, description of the account, and its final debit/credit balance.

Q. Should trial balance and balance sheet match?

The debit and credit totals in the trial balance must match to build the new Income statement and Balance sheet correctly. Also, they must unearth and correct other material errors underlying the account balances during the trial balance period, as well.

Q. Is depreciation shown in trial balance?

Depreciation is appearing in the trial balance of a company. While making final accounts, it should shown in .

Q. How do I know if my trial balance is correct?

Procedure to locate errors in a Trial Balance

- At first, check all ledger account balance one by one.

- Addition of both the columns ( Debit and Credit ) should be checked.

- If any difference, divide the same by 2 and see whether the said figure appears on the correct side or not.

Q. Is there any difference between balance sheet and trial balance?

In a trial balance, each and every account is divided into debit (dr.) and credit (cr.) balances whereas in a balance sheet, each and every account is divided into assets, liabilities and stockholders’ equity.

Q. What are the 3 golden rules of accounting?

To apply these rules one must first ascertain the type of account and then apply these rules.

- Debit what comes in, Credit what goes out.

- Debit the receiver, Credit the giver.

- Debit all expenses Credit all income.

Q. What is trial balance example?

The trial balance is a report run at the end of an accounting period, listing the ending balance in each general ledger account. For example, an accounts payable clerk records a $100 supplier invoice with a debit to supplies expense and a $100 credit to the accounts payable liability account.