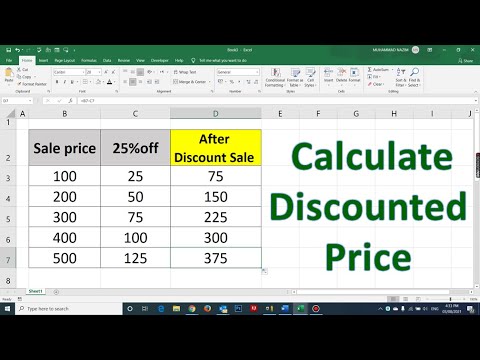

Q. What is formula for discount?

Discount = Marked Price – Selling Price. OR. Discount Percentage Formula = Marked Price × Discount Rate.

Q. What discount rate should I use?

If you are acquiring an existing stabilized asset with credit tenants then you could use a discount rate of around 7%. If you are analyzing a speculative development, you discount rate should be in the high teens. In general, discount rates in real estate fall between 6-12%.

Table of Contents

- Q. What is formula for discount?

- Q. What discount rate should I use?

- Q. What discount rate should I use for NPV?

- Q. Why is NPV better than IRR?

- Q. What is a good NPV for a project?

- Q. Is a higher NPV better?

- Q. What is an acceptable NPV?

- Q. What is a good IRR value?

- Q. Do you want a high or low IRR?

- Q. Can IRR be more than 100%?

- Q. Is ROI the same as IRR?

- Q. How do you calculate IRR quickly?

- Q. How do you calculate IRR mentally?

- Q. Is a 40 IRR good?

- Q. What is the formula for calculating IRR?

- Q. How do you calculate IRR on a calculator?

- Q. Is IRR a percentage?

- Q. What is IRR and NPV?

Q. What discount rate should I use for NPV?

It’s the rate of return that the investors expect or the cost of borrowing money. If shareholders expect a 12% return, that is the discount rate the company will use to calculate NPV. If the firm pays 4% interest on its debt, then it may use that figure as the discount rate.

Q. Why is NPV better than IRR?

The advantage to using the NPV method over IRR using the example above is that NPV can handle multiple discount rates without any problems. Each year’s cash flow can be discounted separately from the others making NPV the better method.

Q. What is a good NPV for a project?

What is a good NPV? In theory, an NPV is “good” if it is greater than zero. After all, the NPV calculation already takes into account factors such as the investor’s cost of capital, opportunity cost, and risk tolerance through the discount rate.

Q. Is a higher NPV better?

If NPV is positive, that means that the value of the revenues (cash inflows) is greater than the costs (cash outflows). When faced with multiple investment choices, the investor should always choose the option with the highest NPV. This is only true if the option with the highest NPV is not negative.

Q. What is an acceptable NPV?

Net present value, commonly seen in capital budgeting projects, accounts for the time value of money (TVM). As a result, and according to the rule, the company should not pursue the project. If a project’s NPV is positive (> 0), the company can expect a profit and should consider moving forward with the investment.

Q. What is a good IRR value?

If you were basing your decision on IRR, you might favor the 20% IRR project. But that would be a mistake. You’re better off getting an IRR of 13% for 10 years than 20% for one year if your corporate hurdle rate is 10% during that period.

Q. Do you want a high or low IRR?

Mathematically, IRR is the rate that would result in the net present value (NPV) of future cash flows equaling exactly zero. A company may choose a larger project with a low IRR because it generates greater cash flows than a small project with a high IRR.

Q. Can IRR be more than 100%?

If you are using units like a year, for which 100% is a high IRR, unusual IRRs are due to mathematical instabilities rather than unusual economics. For example, suppose a project costs $5 million today, returns $12 million in one year and has $4 million of cleanup costs in two years. That’s a 100% IRR.

Q. Is ROI the same as IRR?

ROI indicates total growth, start to finish, of an investment, while IRR identifies the annual growth rate. While the two numbers will be roughly the same over the course of one year, they will not be the same for longer periods.

Q. How do you calculate IRR quickly?

So the rule of thumb is that, for “double your money” scenarios, you take 100%, divide by the # of years, and then estimate the IRR as about 75-80% of that value. For example, if you double your money in 3 years, 100% / 3 = 33%. 75% of 33% is about 25%, which is the approximate IRR in this case.

Q. How do you calculate IRR mentally?

The best way to approximate IRR is by memorizing simple IRRs.

- Double your money in 1 year, IRR = 100%

- Double your money in 2 years, IRR = 41%; about 40%

- Double your money in 3 years, IRR = 26%; about 25%

- Double your money in 4 years, IRR = 19%; about 20%

- Double your money in 5 years, IRR = 15%; about 15%

Q. Is a 40 IRR good?

“a 40% IRR across a 3-month investment is useless. You want a dollar value of proceeds that is meaningful to both you and the LPs.”

Q. What is the formula for calculating IRR?

It is calculated by taking the difference between the current or expected future value and the original beginning value, divided by the original value and multiplied by 100.

Q. How do you calculate IRR on a calculator?

Calculating IRR with a Financial Calculator Example

- Step 1: Press the Cash Flow (CF) Button. This starts the Cash Flow Register when you enter your initial investment.

- Step 2: Press the Down Arrow Once. The calculator should show CF1.

- Step 3: Press the Down Arrow Twice.

- Step 4: Repeat.

- Step 5: Press the IRR Key.

Q. Is IRR a percentage?

Simply stated, the Internal rate of return (IRR) for an investment is the percentage rate earned on each dollar invested for each period it is invested. IRR is also another term people use for interest. Ultimately, IRR gives an investor the means to compare alternative investments based on their yield.

Q. What is IRR and NPV?

What Are NPV and IRR? Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. By contrast, the internal rate of return (IRR) is a calculation used to estimate the profitability of potential investments.