Q. What is MSN price estimate?

Emerson Radio Corp (NYSE American:MSN) The 1 analysts offering 12-month price forecasts for Emerson Radio Corp have a median target of 5.00, with a high estimate of 5.00 and a low estimate of 5.00. The median estimate represents a +320.17% increase from the last price of 1.19.

Table of Contents

- Q. What is MSN price estimate?

- Q. What is the monthly payment on a 4 million dollar home?

- Q. How much is a monthly mortgage payment for a million dollar home?

- Q. What’s the mortgage on a half million dollar house?

- Q. How do I calculate future value of money?

- Q. What would a mortgage payment be on 700 000?

- Q. What is the monthly payment on a 0000 mortgage?

- Q. How much income do you need to buy a 0000 house?

- Q. What is the mortgage on a 0000 house?

- Q. How much is a 500000 mortgage per month?

- Q. How do you determine profitability of an investment?

- Q. What can a refinance calculator do for You?

- Q. How much money can I save by refinancing my mortgage?

- Q. How to get the most accurate mortgage refinance estimate?

- Q. What should my credit score be to refinance my mortgage?

Q. What is the monthly payment on a 4 million dollar home?

Monthly payments on a $1,000,000 mortgage At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total $4,774.15 a month, while a 15-year might cost $7,396.88 a month.

Table of Contents

- Q. What is MSN price estimate?

- Q. What is the monthly payment on a 4 million dollar home?

- Q. How much is a monthly mortgage payment for a million dollar home?

- Q. What’s the mortgage on a half million dollar house?

- Q. How do I calculate future value of money?

- Q. What would a mortgage payment be on 700 000?

- Q. What is the monthly payment on a 0000 mortgage?

- Q. How much income do you need to buy a 0000 house?

- Q. What is the mortgage on a 0000 house?

- Q. How much is a 500000 mortgage per month?

- Q. How do you determine profitability of an investment?

- Q. What can a refinance calculator do for You?

- Q. How much money can I save by refinancing my mortgage?

- Q. How to get the most accurate mortgage refinance estimate?

- Q. What should my credit score be to refinance my mortgage?

Q. How much is a monthly mortgage payment for a million dollar home?

Monthly mortgage payments on a 1 million dollar home will depend on several factors, including your credit score, down payment, term, and interest rate. Generally speaking, on a 30-year mortgage with 20% down, you can expect to pay around $4,500 in monthly mortgage payments on a million-dollar home.

Q. What’s the mortgage on a half million dollar house?

Here’s what monthly payments might look like on a $1 million home

| LOAN TERMS | MORTGAGE PRINCIPAL AND INTEREST | EST. MONTHLY PAYMENT (INC. TAXES & INSURANCE) |

|---|---|---|

| 30-year fixed rate at 3.25% | $3,480 | $4,675 |

| 15-year fixed rate at 2.5% | $5,330 | $6,525 |

Q. How do I calculate future value of money?

The future value formula is FV=PV(1+i)n, where the present value PV increases for each period into the future by a factor of 1 + i. The future value calculator uses multiple variables in the FV calculation: The present value sum. Number of time periods, typically years.

Q. What would a mortgage payment be on 700 000?

How much would the mortgage payment be on a $700K house? Assuming you have a 20% down payment ($140,000), your total mortgage on a $700,000 home would be $560,000. For a 30-year fixed mortgage with a 3.5% interest rate, you would be looking at a $2,515 monthly payment.

Q. What is the monthly payment on a $500000 mortgage?

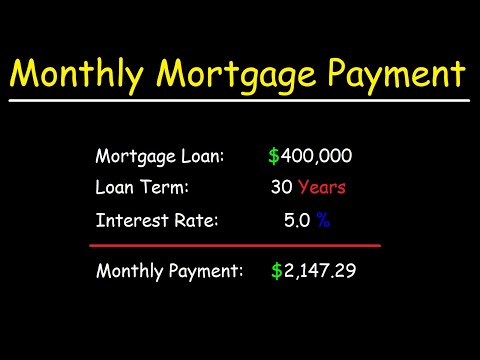

Monthly payments on a $500,000 mortgage At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total $2,387.08 a month, while a 15-year might cost $3,698.44 a month.

Q. How much income do you need to buy a $300000 house?

This means that to afford a $300,000 house, you’d need $60,000. Closing costs: Typically, you’ll pay around 3% to 5% of a home’s value in closing costs.

Q. What is the mortgage on a $300000 house?

A $300,000 mortgage comes with upfront and long-term costs….Monthly payments for a $300,000 mortgage.

| Annual Percentage Rate (APR) | Monthly payment (15 year) | Monthly payment (30 year) |

|---|---|---|

| 3.50% | $2,144.65 | $1,347.13 |

Q. How much is a 500000 mortgage per month?

Q. How do you determine profitability of an investment?

NPV is an investment criterion that consists of discounting future cash flows (collections and payments). In other words, bring the expected cash flows to the present, discounting them at a given rate. Thus, the NPV will express a measure of a project’s profitability in absolute terms.

Q. What can a refinance calculator do for You?

Refinance Calculator. The refinance calculator can help plan the refinancing of a loan given various situations, and also allows the side-by-side comparison of the existing or refinanced loan.

Q. How much money can I save by refinancing my mortgage?

While our calculator can give you an idea of your potential refinance savings, you’ll still have to do legwork to find your loan. According to Freddie Mac, borrowers who get at least five rate quotes can save about $1,435 on a $250,000 loan by getting one additional quote.

Q. How to get the most accurate mortgage refinance estimate?

In order to get the most accurate estimate, select the credit score that best represents your credit history. Money’s calculator results are for illustrative purposes only and not guaranteed. Money uses regional averages, so your mortgage payment may vary.

Q. What should my credit score be to refinance my mortgage?

Depending on your needs, refinancing could make sense if it can achieve one of five things: In general, this move makes the most sense if you can lower your rate by at least one percentage point. To qualify for the lowest possible interest rate, you’ll generally need to have a credit score of at least 740.