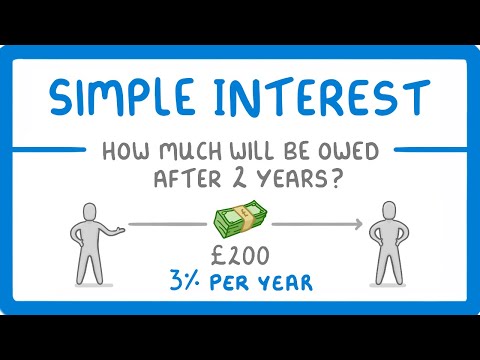

Investment problems usually involve simple annual interest (as opposed to compounded interest), using the interest formula I = Prt, where I stands for the interest on the original investment, P stands for the amount of the original investment (called the “principal”), r is the interest rate (expressed in decimal form).

Table of Contents

- Q. What is simple interest and example?

- Q. What is simple interest in math terms?

- Q. How do you solve simple interest examples?

- Q. How do you answer simple interest?

- Q. Who uses simple interest?

- Q. What is simple interest in math?

- Q. What are some examples of simple interest?

- Q. Is simple interest good or bad?

- Q. What type of loans are simple interest?

- Q. How do you beat simple interest?

- Q. What is a disadvantage of simple interest?

- Q. Is simple interest better than compound?

- Q. Is a daily simple interest loan bad?

- Q. Do banks use simple interest?

- Q. Why is simple interest useful?

- Q. How do you calculate interest rate example?

- Q. How do you calculate interest payments?

- Q. What is the monthly payment on a 000 loan?

- Q. What is the formula for monthly payments?

- Q. What is the monthly payment on a 000 loan?

- Q. What is the payment on a 000 car?

- Q. How can I get a 50000 loan?

- Q. What is a good down payment?

- Q. How much should you put down on a 50000 car?

Q. What is simple interest and example?

Generally, simple interest paid or received over a certain period is a fixed percentage of the principal amount that was borrowed or lent. For example, say a student obtains a simple-interest loan to pay one year of college tuition, which costs $18,000, and the annual interest rate on the loan is 6%.

Table of Contents

- Q. What is simple interest and example?

- Q. What is simple interest in math terms?

- Q. How do you solve simple interest examples?

- Q. How do you answer simple interest?

- Q. Who uses simple interest?

- Q. What is simple interest in math?

- Q. What are some examples of simple interest?

- Q. Is simple interest good or bad?

- Q. What type of loans are simple interest?

- Q. How do you beat simple interest?

- Q. What is a disadvantage of simple interest?

- Q. Is simple interest better than compound?

- Q. Is a daily simple interest loan bad?

- Q. Do banks use simple interest?

- Q. Why is simple interest useful?

- Q. How do you calculate interest rate example?

- Q. How do you calculate interest payments?

- Q. What is the monthly payment on a 000 loan?

- Q. What is the formula for monthly payments?

- Q. What is the monthly payment on a 000 loan?

- Q. What is the payment on a 000 car?

- Q. How can I get a 50000 loan?

- Q. What is a good down payment?

- Q. How much should you put down on a 50000 car?

Q. What is simple interest in math terms?

What Is Simple Interest? Simple interest is a quick and easy method of calculating the interest charge on a loan. Simple interest is determined by multiplying the daily interest rate by the principal by the number of days that elapse between payments.

Q. How do you solve simple interest examples?

Examples of finding the interest earned with the simple interest formula

- In many simple interest problems, you will be finding the total interest earned over a set period, which is represented as I.

- Let’s use an example to see how this formula works.

- I=Prt=500(0.04)(2)=40.

- t=412=13.

- I=Prt=1200(0.06)(13)=24.

Q. How do you answer simple interest?

Simple Interest Formulas and Calculations:

- Calculate Interest, solve for I. I = Prt.

- Calculate Principal Amount, solve for P. P = I / rt.

- Calculate rate of interest in decimal, solve for r. r = I / Pt.

- Calculate rate of interest in percent. R = r * 100.

- Calculate time, solve for t. t = I / Pr.

Q. Who uses simple interest?

Simple interest usually applies to loans like car loans, student loans, and even mortgages. You might also see simple interest when taking out consumer loans. Some larger stores will let you finance household appliances with simple interest for periods up to 12-24 months’ payment.

Q. What is simple interest in math?

Simple interest is interest that is only calculated on the initial amount of the loan. This means you are paying the same amount of interest every year. An example of simple interest is when someone purchases a U.S. Treasury Bond. Simple Interest.

Q. What are some examples of simple interest?

Car loans, amortized monthly, and retailer installment loans, also calculated monthly, are examples of simple interest; as the loan balance dips with each monthly payment, so does the interest. Certificates of deposit (CDs) pay a specific amount in interest on a set date, representing simple interest.

Q. Is simple interest good or bad?

Essentially, simple interest is good if you’re the one paying the interest, because it will cost less than compound interest. However, if you’re the one collecting the interest—say, if you have money deposited in a savings account—then simple interest is bad.

Q. What type of loans are simple interest?

Simple interest applies mostly to short-term loans, such as personal loans. A simple-interest mortgage charges daily interest instead of monthly interest. When the mortgage payment is made, it is first applied to the interest owed. Any money that’s left over is applied to the principal.

Q. How do you beat simple interest?

A borrower can take advantage of the way simple interest auto loans are structured and save money over the course of that loan. This can be accomplished by reducing the loan term, paying more than the monthly amount, and payment splitting.

Q. What is a disadvantage of simple interest?

The disadvantages in simple interest are that if the interest rate is high then the borrower will pay more. In addition, if the time (years) to be paid back is longer then again the borrower pays more.

Q. Is simple interest better than compound?

Compared to compound interest, simple interest is easier to calculate and easier to understand. When it comes to investing, compound interest is better since it allows funds to grow at a faster rate than they would in an account with a simple interest rate.

Q. Is a daily simple interest loan bad?

A recap on daily simple interest Interest accrues daily. By paying more than your scheduled payment or paying early, you can potentially reduce the amount of payments you have to make and lower the amount of interest you pay. If you miss a payment or pay late, you’ll end up paying more interest.

Q. Do banks use simple interest?

Most financial institutions offering fixed deposits use compounding to calculate the interest amount on the principal. However, some banks and NBFCs do use simple interest methods as well.

Q. Why is simple interest useful?

Because it is simple, you have to do fewer calculations than if you saved money without it. Simple interest allows your money to earn money, so you have to save less.

Q. How do you calculate interest rate example?

The formula for calculating simple interest is:

- (P x r x t) ÷ 100.

- (P x r x t) ÷ (100 x 12)

- FV = P x (1 + (r x t))

- Example 1: If you invest Rs.50,000 in a fixed deposit account for a period of 1 year at an interest rate of 8%, then the simple interest earned will be:

Q. How do you calculate interest payments?

Divide your interest rate by the number of payments you’ll make that year. If you have a 6 percent interest rate and you make monthly payments, you would divide 0.06 by 12 to get 0.005. Multiply that number by your remaining loan balance to find out how much you’ll pay in interest that month.

Q. What is the monthly payment on a $10000 loan?

In another scenario, the $10,000 loan balance and five-year loan term stay the same, but the APR is adjusted, resulting in a change in the monthly loan payment amount….How your loan term and APR affect personal loan payments.

| Your payments on a $10,000 personal loan | ||

|---|---|---|

| Monthly payments | $201 | $379 |

| Interest paid | $2,060 | $12,712 |

Q. What is the formula for monthly payments?

Amortized Loan Payment Formula To calculate the monthly payment, convert percentages to decimal format, then follow the formula: a: 100,000, the amount of the loan. r: 0.005 (6% annual rate—expressed as 0.06—divided by 12 monthly payments per year) n: 360 (12 monthly payments per year times 30 years)

Q. What is the monthly payment on a $30000 loan?

For example, the total interest on a $30,000, 60-month loan at 4% would be $3,150. So, your monthly payment would be $552.50 ($30,000 + $3,150 ÷ 60 = $552.50).

Q. What is the payment on a $30000 car?

It’s based on average credit, no money down, and financing for five years. If you change any of those variables your payment will change. So, for example, if you’re looking at a $20,000 car, the payments will be roughly $400 a month. A $30,000 car, roughly $600 a month.

Q. How can I get a 50000 loan?

How to Apply for Rs. 50,000 Loan?

- Provide your personal and financial details while filling the application form online.

- Choose a loan amount and suitable tenor to get instant approval.

- A Bajaj Finserv representative will get in touch with you.

- Receive the approved loan amount in your account shortly.

Q. What is a good down payment?

As a general rule, aim for no less than 20% down, particularly for new cars — and no less than 10% down for used cars — so that you don’t end up paying too much in interest and financing costs. Benefits of making a down payment can include a lower monthly payment and less interest paid over the life of the loan.

Q. How much should you put down on a 50000 car?

The vehicle’s price determines how much cash you should put down

| Vehicle Price | 15% Down | 25% Down |

|---|---|---|

| $30,000 | $4,500 | $7,500 |

| $35,000 | $5,250 | $8,750 |

| $40,000 | $6,000 | $10,000 |

| $50,000 | $7,500 | $12,500 |