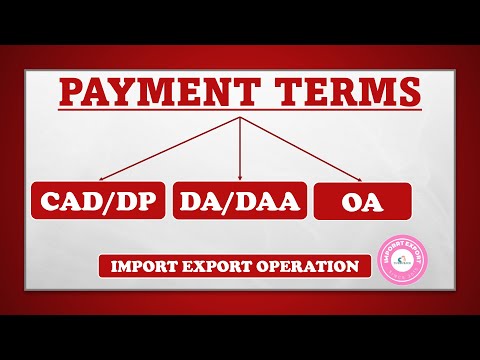

Cash Against Documents (CAD) – Buyer deposits cash with its local (foreign) bank. Seller presents documents to its U.S. bank for “collection”. Until such arrangements are made the bank holds the Draft and the documents. SD/DP means the bank pays at “sight”, i.e., upon presentation with the documents.

Q. What is DP in international trade?

Cash Against Documents CAD payment term / DP in export, happens when the buyer needs to pay the amount due at sight. This payment is made before the documents are released by the buyer’s bank (collecting bank). It is also known as sight draft or cash against documents.

Table of Contents

- Q. What is DP in international trade?

- Q. What does DP and DAP mean?

- Q. What is DA in export?

- Q. What is DP in import?

- Q. What is DP in trade finance?

- Q. What is DP terms of payment?

- Q. What is DP invoice?

- Q. What is DP in shipping?

- Q. Whats is DP?

- Q. What does bank documents against payments DP mean?

- Q. What’s the difference between a DP and a DAP?

- Q. What should stock be considered for calculating DP?

- Q. What’s the difference between D / P and cash on delivery?

Q. What does DP and DAP mean?

Documents against Payments

DP and DAP is same as it elaborates as Documents against Payments. Some in trade call as DP and some call as DAP. The meaning of both is Documents against Payment. However, in terms of delivery, DAP means Delivered at Place with a named destination place. What is DP/DAP in terms of payment?

Q. What is DA in export?

Payment terms ‘DA’ means Documents against Acceptance. As per D.A terms, once the shipping documents along with bills of exchange received by the buyer’s bank, the buyer is informed to accept documents by buyer’s bank.

Q. What is DP in import?

DP in payment term of imports and exports means Documents against Payments. The importer collects shipping documents required to take delivery of imported goods from his bank after such assurance on payment at mutually agreed maturity date of payment.

Q. What is DP in trade finance?

DA in payment term of international trade means, Documents against Acceptance. DP in payment term of imports and exports means Documents against Payments. Both DA and DP are the terms of payment related to acceptance of shipping documents pertaining to each consignment from buyer’s bank.

Q. What is DP terms of payment?

DP OR DAP term of payment is one of the terms of payment in international trade. D.A.P or D/P terms of payment means, Documents Against Payment. After receipt of such shipping documents by buyer’s bank notifies buyer on receipt of documents and advise to ‘accept’ the documents by effecting payment of export proceeds.

Q. What is DP invoice?

In the case of Delivery against Payment (DP) bills, the drawee collects the ‘documents of title to goods’ from the bank after making the payment of invoice value to the bank and takes the delivery of goods consigned to him from the carrier.

Q. What is DP in shipping?

DP OR DAP term of payment is one of the terms of payment in international trade. D.A.P or D/P terms of payment means, Documents Against Payment. Under a DP terms of payment (DAP terms of payment), the buyer collects original shipping documents from his bank after making necessary payment against sale of goods.

Q. Whats is DP?

DP stands for Display Picture. Display picture can be defined as: “A highlighted picture of one person on social media or other internet chat profile to represent his visual identity.” It is also known as profile picture, but as it does not portray your profile, most people prefer to call it a Display Picture (DP).

Q. What does bank documents against payments DP mean?

Documents Against Payments (D/P) This is sometimes also referred as Cash against Documents/Cash on Delivery. In effect D/P means payable at sight (on demand). The collecting bank hands over the shipping documents including the document of title (bill of lading) only when the importer has paid the bill.

Q. What’s the difference between a DP and a DAP?

In a payment terms are concerned, DP and DAP are one of the same. DP and DAP is same as it elaborates as Documents against Payments. Some in trade call as DP and some call as DAP. The meaning of both is Documents against Payment. However, in terms of delivery, DAP means Delivered at Place with a named destination place.

Q. What should stock be considered for calculating DP?

An important point to note is that “Stock” considered for calculating DP should be insured stock. Stock not covered under insurance, if considered for drawing power does not reflect the true drawing power since bank runs a huge risk, in the case of any mishappening.

Q. What’s the difference between D / P and cash on delivery?

This is sometimes also referred as Cash against Documents/Cash on Delivery. In effect D/P means payable at sight (on demand). The collecting bank hands over the shipping documents including the document of title (bill of lading) only when the importer has paid the bill.