Q. What is the formula to annualize?

To annualize a number, multiply the shorter-term rate of return by the number of periods that make up one year. One month’s return would be multiplied by 12 months while one quarter’s return by four quarters.

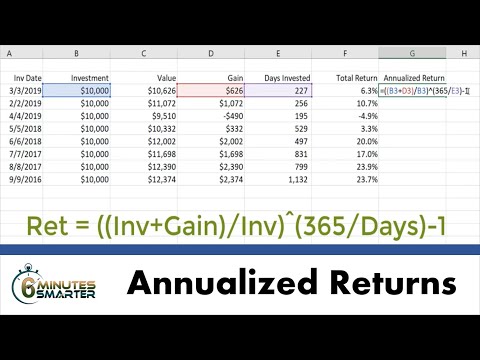

Q. How do I Annualize in Excel?

An Excel formula to annualize data

Table of Contents

- Q. What is the formula to annualize?

- Q. How do I Annualize in Excel?

- Q. How do I calculate percentage return?

- Q. How do you calculate rolling returns?

- Q. What is rolling return calculation?

- Q. What is Fvschedule in Excel?

- Q. What is annualization factor?

- Q. How do you annualize quarterly GDP data?

- Q. How do I annualize a number?

- Q. How do you annualize data?

- Q. How do you calculate total annual income?

- Q. How to calculate YTD annualization?

- =[Value for 1 month] * 12. This works because there are 12 months in a year.

- =[Value for 2 months] * 6. This works because there are 6 periods of 2 months in a year.

- =[Value for X months] * (12 / [Number of months])

Q. How do I calculate percentage return?

Divide the ending amount by the starting amount. For example, if you started with a $44,000 investment and ended with a $54,000 value, you would divide $54,000 by $44,000 to get 1.2273. Subtract 1 from the previous step’s result to find the return expressed as a decimal.

Q. How do you calculate rolling returns?

Take the ending price and subtract the beginning price, then divide that amount by the beginning price to find that year’s return. Next, you’ll use averaging to calculate rolling returns. Add up the return percentages you calculated for each year of the time period you’re tracking.

Q. What is rolling return calculation?

Rolling returns of a mutual fund schemes are annualized returns of the scheme on different dates for specified investment tenure. Rolling returns are calculated for rolling period beginning with a certain date and investment tenure, and then returns for all consecutive dates (same tenure) are also calculated.

Q. What is Fvschedule in Excel?

The Excel FVSCHEDULE function returns the future value of a single sum based on a schedule of given interest rates. FVSCHEDULE can be used to find the future value of an investment with a variable or adjustable rate. Get future value of principal compound interest.

Q. What is annualization factor?

Get an annualization factor — a number that allows you to extend your current rate of return over the remaining months in the year — by dividing the number of the month you are currently in by 12. For example, if you are calculating YTD annualization in May, divide 12 by 5 to get an annualization factor of 2.4.

Q. How do you annualize quarterly GDP data?

The formula for calculating an annual rate from quarterly numbers involves dividing the current quarter’s GDP by the previous quarter’s, taking the result to the fourth power and subtracting by one. But you can approximate the result pretty well by multiplying the quarterly percentage change by four.

Q. How do I annualize a number?

To annualize a number, multiply the shorter-term rate of return by the number of periods that make up one year. One month’s return would be multiplied by 12 months while one quarter’s return by four quarters.

Q. How do you annualize data?

An Excel formula to annualize data. To annualize data from a single month, the formula will be: =[Value for 1 month] * 12. This works because there are 12 months in a year. If you had 2 months of data, the formula would be: =[Value for 2 months] * 6.

Q. How do you calculate total annual income?

Calculate your annual salary. Find your total gross earnings, before deductions, on your pay stub. Multiply this amount by the number of paychecks you receive each year to calculate your total annual salary. Suppose you are paid biweekly, and your total gross salary is $1,900.

Q. How to calculate YTD annualization?

Method 3 of 3: Annualizing Year-to-Date Returns Determine when to use this calculation. In some cases, particularly for investments, your returns may not be clearly stated as monthly, quarterly, or weekly rates. Find this year’s return to date. Find how much your investment had made or lost this year in dollars (or your local currency). Convert this number into a percentage return.