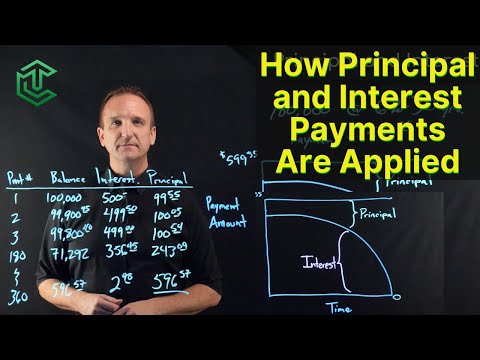

Principal is the money that you originally agreed to pay back. Next, remaining money from your payment will be applied to any interest due, including past due interest, if applicable. Then the rest of your payment will be applied to the principal balance of your loan.

Table of Contents

- Q. What is principal amount with example?

- Q. What is principal amount in simple words?

- Q. How do you calculate principal?

- Q. How is principal repaid calculated?

- Q. How is principal and interest calculated?

- Q. Is it better to pay on the principal or interest?

- Q. What happens if I pay an extra 0 a month on my mortgage?

- Q. What happens if you make 1 extra mortgage payment a year?

- Q. How much extra should I pay towards principal?

- Q. What happens if I make a principal only payment?

- Q. Can I pay just the principal on my mortgage?

Q. What is principal amount with example?

more The total amount of money borrowed (or invested), not including any interest or dividends. Example: Alex borrows $1,000 from the bank. The Principal of the loan is $1,000.

Table of Contents

- Q. What is principal amount with example?

- Q. What is principal amount in simple words?

- Q. How do you calculate principal?

- Q. How is principal repaid calculated?

- Q. How is principal and interest calculated?

- Q. Is it better to pay on the principal or interest?

- Q. What happens if I pay an extra 0 a month on my mortgage?

- Q. What happens if you make 1 extra mortgage payment a year?

- Q. How much extra should I pay towards principal?

- Q. What happens if I make a principal only payment?

- Q. Can I pay just the principal on my mortgage?

Q. What is principal amount in simple words?

Principal amount on a loan is the amount borrowed. According to the terms of the loan, John had to pay it off in five years with an interest rate of 10%. The initial amount that he borrowed, or the $7,500, is called the principal amount of the loan.

Q. How do you calculate principal?

The principal is the amount of money you borrow when you originally take out your home loan. To calculate your principal, simply subtract your down payment from your home’s final selling price.

Q. How is principal repaid calculated?

Subtract the interest owed for the period from your payment on the loan to determine the amount of principal repayment for the period. Finishing the example, if you make a monthly payment of $200, subtract $106.50 of interest to find that you’ve repaid $93.50 of principal.

Q. How is principal and interest calculated?

Divide your interest rate by the number of payments you’ll make in the year (interest rates are expressed annually). So, for example, if you’re making monthly payments, divide by 12. 2. Multiply it by the balance of your loan, which for the first payment, will be your whole principal amount.

Q. Is it better to pay on the principal or interest?

1. Save on interest. Since your interest is calculated on your remaining loan balance, making additional principal payments every month will significantly reduce your interest payments over the life of the loan. Paying down more principal increases the amount of equity and saves on interest before the reset period.

Q. What happens if I pay an extra $200 a month on my mortgage?

If you’re able to make $200 in extra principal payments each month, you could shorten your mortgage term by eight years and save over $43,000 in interest.

Q. What happens if you make 1 extra mortgage payment a year?

3. Make one extra mortgage payment each year. Making an extra mortgage payment each year could reduce the term of your loan significantly. For example, by paying $975 each month on a $900 mortgage payment, you’ll have paid the equivalent of an extra payment by the end of the year.

Q. How much extra should I pay towards principal?

Most mortgages provide you the option to pay extra on your principal if you wish. You could, for example, pay an extra $50 or $100 each month, or make one extra mortgage payment a year. The benefit in taking this approach is that it will, over the life of the loan, reduce the total amount of interest you pay.

Q. What happens if I make a principal only payment?

The principal is the amount you borrowed. The interest is what you pay to borrow that money. But if you designate an additional payment toward the loan as a principal-only payment, that money goes directly toward your principal — assuming the lender accepts principal-only payments.

Q. Can I pay just the principal on my mortgage?

A principal-only mortgage payment, also known as an additional principal payment, is a supplementary payment applied directly to your mortgage loan principal amount. It exceeds the scheduled monthly amount; thus, possibly saving you on interest and helping you to pay off your mortgage early.