Q. What ore is magnesium extracted from?

Magnesium is found in minerals such as magnesite, dolomite, brucite, serpentinite, etc. and is mostly recovered from seawater, brines and bitterns [2]. Dolomite ore is considered one of the most suitable ores for obtaining magnesium and its various compounds.

Table of Contents

- Q. What ore is magnesium extracted from?

- Q. How is magnesium metal extracted?

- Q. How is magnesium mined?

- Q. Is Magnesium an ore?

- Q. Where is magnesium mainly found?

- Q. Is Magna stock overvalued?

- Q. How much is Royal Bank dividend?

- Q. Which bank pays highest dividend?

- Q. Does Royal Bank pay a dividend?

- Q. Is RBC a good dividend stock?

- Q. Which is the best Canadian bank stock to buy?

- Q. Which Canadian bank pays the best dividend?

- Q. Which Canadian bank is the best investment?

- Q. Why is CIBC stock so high?

- Q. Is it better to invest with a bank or a broker in Canada?

- Q. What are the safest investments in Canada?

- Q. Where can I invest 0 000 today?

- Q. What’s the best investment in 2020?

- Q. What is the most safest investment?

Q. How is magnesium metal extracted?

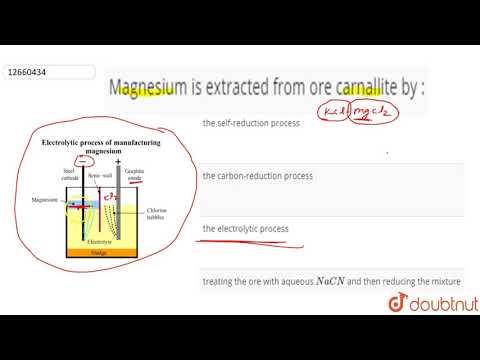

To extract the magnesium, calcium hydroxide is added to seawater to form magnesium hydroxide precipitate. Magnesium hydroxide (brucite) is insoluble in water and can be filtered out and reacted with hydrochloric acid to produced concentrated magnesium chloride. From magnesium chloride, electrolysis produces magnesium.

Table of Contents

- Q. What ore is magnesium extracted from?

- Q. How is magnesium metal extracted?

- Q. How is magnesium mined?

- Q. Is Magnesium an ore?

- Q. Where is magnesium mainly found?

- Q. Is Magna stock overvalued?

- Q. How much is Royal Bank dividend?

- Q. Which bank pays highest dividend?

- Q. Does Royal Bank pay a dividend?

- Q. Is RBC a good dividend stock?

- Q. Which is the best Canadian bank stock to buy?

- Q. Which Canadian bank pays the best dividend?

- Q. Which Canadian bank is the best investment?

- Q. Why is CIBC stock so high?

- Q. Is it better to invest with a bank or a broker in Canada?

- Q. What are the safest investments in Canada?

- Q. Where can I invest 0 000 today?

- Q. What’s the best investment in 2020?

- Q. What is the most safest investment?

Q. How is magnesium mined?

Both dolomite and magnesite are mined and concentrated by conventional methods. Carnallite is dug as ore or separated from other salt compounds that are brought to the surface by solution mining. Naturally occurring magnesium-containing brines are concentrated in large ponds by solar evaporation.

Q. Is Magnesium an ore?

Formation. Magnesite (MgCO3) is an ore for magnesium production.

Q. Where is magnesium mainly found?

Magnesium is the eighth most abundant element in the Earth’s crust, but does not occur uncombined in nature. It is found in large deposits in minerals such as magnesite and dolomite. The sea contains trillions of tonnes of magnesium, and this is the source of much of the 850,000 tonnes now produced each year.

Q. Is Magna stock overvalued?

Because Magna International is significantly overvalued, the long-term return of its stock is likely to be much lower than its future business growth, which averaged 3.7% over the past three years and is estimated to grow 0.20% annually over the next three to five years.

Q. How much is Royal Bank dividend?

TORONTO, May 27, 2021 /CNW/ – Royal Bank of Canada (TSX: RY) (NYSE: RY) announced today that its board of directors has declared a quarterly common share dividend of $1.08 per share, payable on and after August 24, 2021, to common shareholders of record at the close of business on July 26, 2021.

Q. Which bank pays highest dividend?

10 Banks to Watch

- Bank of America Corp. (BAC): +8.4% YTD; 1.5% yield; 126% dividend growth through 2019.

- BB Corp.

- Citigroup Inc.

- Citizens Financial Group Inc.

- Fifth Third Bancorp (FITB): +9.6% YTD; 1.9% yield; 87% dividend growth through 2019.

- PNC Financial Services Group Inc.

- Regions Financial Corp.

- SunTrust Banks Inc.

Q. Does Royal Bank pay a dividend?

Royal Bank of Canada pays an annual dividend of C$4.32 per share, with a dividend yield of 3.42%.

Q. Is RBC a good dividend stock?

Royal Bank is a Canadian Dividend Aristocrat with a solid track record of dividend growth. It last raised its dividend payout by 2.8% and has a juicy yield of more than 4% presently. The bank has returned more than 60% of its 2020 earnings to shareholders through dividends and buybacks.

Q. Which is the best Canadian bank stock to buy?

What are the best Canadian bank stocks to own today?

- Canadian Imperial Bank of Commerce (TSE:CM)

- Bank of Montreal (TSE:BMO)

- Toronto Dominion Bank (TSE:TD)

- National Bank of Canada (TSE:NA)

- Royal Bank of Canada (TSE:RY)

Q. Which Canadian bank pays the best dividend?

The best dividend stocks in Canada

- Power Financial Corporation (PWF.TO)

- Great-West Lifeco Inc.

- Power Corporation of Canada (POW.TO)

- Exco Technologies Limited (XTC.TO)

- Emera Incorporated (EMA.TO)

- National Bank of Canada (NA.TO)

- Methanex Corporation (MX.TO)

- Canadian Natural Resources Limited (CNQ.TO) Dividend yield: 3.58%

Q. Which Canadian bank is the best investment?

Read on for details on picking a bank stock but the best Canadian bank stock this year is National Bank and the safest banks to hold are TD Bank and Royal Bank.

Q. Why is CIBC stock so high?

One of the reasons CIBC’s yield is so high is because it’s a very cheap stock. At current prices, it trades at 13.8 times earnings and 1.48 times book value. Those are low multiples even for banks. When a stock’s price is low relative to earnings, it’s easier for it to have a high yield.

Q. Is it better to invest with a bank or a broker in Canada?

Which bank is best for stock trading in Canada? Many Canadian banks offer customers the ability to buy and sell shares of stock. However, the costs to trade are almost always more expensive than using a standalone discount online broker such as Questrade or Qtrade.

Q. What are the safest investments in Canada?

A GIC is one of the safest investments you can make, and it can be held in both non-registered and registered (TFSA, RRSP, RESP, RRIF) accounts. Because your money is literally tied-up for 1-5 years, GICs tend to pay higher interest rates than savings accounts (which you can access any time).

Q. Where can I invest $500 000 today?

How to Invest $500,000 Starting Today

- Stock Market. Suggested Allocation: 40% to 50%

- Real Estate. Suggested Allocation: 10% to 15%

- Investing in Gold. Suggested Allocation: 10% to 15%

- Cryptocurrency. Suggested Allocation: 5%

- Buy a Business. Suggested Allocation: Varies.

- Open a Solo 401(k) Suggested % Allocation: Varies.

Q. What’s the best investment in 2020?

Here is my list of the seven best investments to make in 2020:

- 1: Stay the Course with Stocks – But Tweak Your Portfolio.

- 2: Real Estate Investment Trusts (REITs)

- 3: Invest in Yourself.

- 4: Invest in a Side Business.

- 5: Payoff Debt.

- 6: Starting or Supercharging Retirement Savings.

- 7: Spending Time with Family.

Q. What is the most safest investment?

U.S. government bills, notes, and bonds, also known as Treasuries, are considered the safest investments in the world and are backed by the government.