Interpreting Our Cointegration Results The Engle-Granger test statistic for cointegration reduces to an ADF unit root test of the residuals of the cointegration regression: If the residuals contain a unit root, then there is no cointegration. The null hypothesis of the ADF test is that the residuals have a unit root.

Q. How do you do Granger causality test in Gretl?

Dear Logan, GRETL automatically computes Granger causality tests. As stated in the guide: “For each variable in the system an F test is automatically performed, in which the null hypothesis is that no lags of variable j are significant in the equation for variable i. This is commonly known as a Granger causality test”.

Table of Contents

- Q. How do you do Granger causality test in Gretl?

- Q. What is Johansen cointegration test?

- Q. Why is cointegration important?

- Q. What is Engle Granger cointegration test?

- Q. How do you calculate cointegration in Excel?

- Q. How do you test for cointegration in R?

- Q. What is the meaning of cointegration?

- Q. What is Vecm model?

- Q. What does integrated of order 1 mean?

Q. What is Johansen cointegration test?

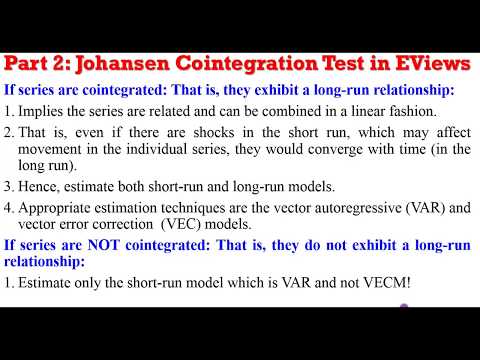

Cointegration > Johansen’s test is a way to determine if three or more time series are cointegrated. More specifically, it assesses the validity of a cointegrating relationship, using a maximum likelihood estimates (MLE) approach.

Q. Why is cointegration important?

A cointegration test is used to establish if there is a correlation between several time series. Time series datasets record observations of the same variable over various points of time. Financial analysts use time series data such as stock price movements, or a company’s sales over time in the long term.

Q. What is Engle Granger cointegration test?

The Engle Granger test is a test for cointegration. It constructs residuals (errors) based on the static regression. The test uses the residuals to see if unit roots are present, using Augmented Dickey-Fuller test or another, similar test. The residuals will be practically stationary if the time series is cointegrated.

Q. How do you calculate cointegration in Excel?

The steps to perform cointegration test on two price series in excel are as follows: Consider two stocks as X and Y. Interpreting Results: If t stat value < -2.59, X and Y are cointegrated with more than 90% certainty.

Q. How do you test for cointegration in R?

To test for cointegration, one should compare the t-ratio of the lagged term shown as ‘statistic’ in Equation 12.3, t=−3.927 to the critical value of −3.37. The result is to reject the null of no cointegration, which means the series are cointegrated.

Q. What is the meaning of cointegration?

Cointegration is the existence of long-run relationship between two or more variables. However, the correlation does not necessarily means “long-run”. Correlation is simply a measure of the degree of mutual association between two or more variables.

Q. What is Vecm model?

A vector error correction (VEC) model is a restricted VAR that has cointegration restrictions built into the specification, so that it is designed for use with nonstationary series that are known to be cointegrated.

Q. What does integrated of order 1 mean?

– A series with a unit root (a random walk) is said to. be integrated of order one, or I(1) – A stationary series without a trend is said to be. integrated of order 0, or I(0) – An I(1) series is differenced once to be I(0)