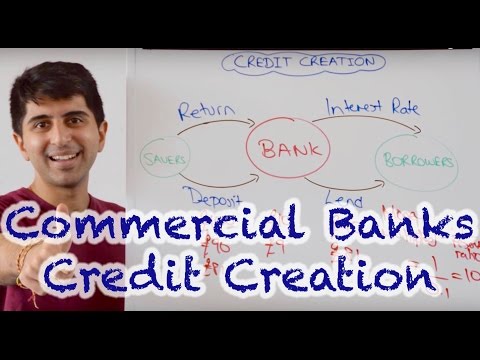

Is a model that illustrates how banks can create money. The rate at which credit is created depends on the reserve ratio and the capital ratio for banks. Below is the formula to calculat the credit multiplier i.e. the change in deposits divided by the change in reserves.

Table of Contents

- Q. What is the relationship between CRR and money multiplier?

- Q. What is the formula of credit multiplier?

- Q. What is Money Multiplier example?

- Q. How do you calculate a multiplier?

- Q. What is the negative multiplier effect?

- Q. What is the Keynesian multiplier formula?

- Q. What is the multiplier principle?

- Q. When MPC is 0.9 What is the multiplier?

- Q. What is the importance of multiplier?

- Q. Why is the multiplier greater than 1?

- Q. Why is the multiplier smaller in an open economy?

- Q. Can a multiplier be less than 1?

- Q. Can money multiplier be less than 1?

- Q. What is the simple deposit multiplier formula?

- Q. What is the minimum value of money multiplier?

- Q. What are the determinants of money multiplier?

- Q. What is the maximum amount the bank can create?

- Q. What is Money Multiplier what determines the value of this multiplier?

- Q. How does LRR affect the value of money multiplier?

- Q. What is Money Multiplier what determines the value of this multiplier Class 12?

- Q. What is meant by deposit multiplier?

- Q. How do banks create money from a 000 deposit?

- Q. Which function of money does a penny not serve well?

- Q. Can banks loan more money than they have?

- Q. Where do banks borrow money from?

Q. What is the relationship between CRR and money multiplier?

The bank’s reserve requirement ratio determines how much money is available to loan out and therefore the amount of these created deposits. The deposit multiplier is then the ratio of the amount of the checkable deposits to the reserve amount. The deposit multiplier is the inverse of the reserve requirement ratio.

Table of Contents

- Q. What is the relationship between CRR and money multiplier?

- Q. What is the formula of credit multiplier?

- Q. What is Money Multiplier example?

- Q. How do you calculate a multiplier?

- Q. What is the negative multiplier effect?

- Q. What is the Keynesian multiplier formula?

- Q. What is the multiplier principle?

- Q. When MPC is 0.9 What is the multiplier?

- Q. What is the importance of multiplier?

- Q. Why is the multiplier greater than 1?

- Q. Why is the multiplier smaller in an open economy?

- Q. Can a multiplier be less than 1?

- Q. Can money multiplier be less than 1?

- Q. What is the simple deposit multiplier formula?

- Q. What is the minimum value of money multiplier?

- Q. What are the determinants of money multiplier?

- Q. What is the maximum amount the bank can create?

- Q. What is Money Multiplier what determines the value of this multiplier?

- Q. How does LRR affect the value of money multiplier?

- Q. What is Money Multiplier what determines the value of this multiplier Class 12?

- Q. What is meant by deposit multiplier?

- Q. How do banks create money from a 000 deposit?

- Q. Which function of money does a penny not serve well?

- Q. Can banks loan more money than they have?

- Q. Where do banks borrow money from?

Q. What is the formula of credit multiplier?

The total amount of deposits created by the banking system as a whole as a multiple of the initial increase in the primary deposit is called the credit multiplier. 400 and the total deposit created by the entire commercial banks is Rs. 2000, then the credit multiplier will be 2000/400 = 5.

Q. What is Money Multiplier example?

The Money Multiplier refers to how an initial deposit can lead to a bigger final increase in the total money supply. For example, if the commercial banks gain deposits of £1 million and this leads to a final money supply of £10 million. The money multiplier is 10.

Q. How do you calculate a multiplier?

The equity multiplier is a commonly used financial ratio calculated by dividing a company’s total asset value by total net equity.

Q. What is the negative multiplier effect?

The negative multiplier effect occurs when an initial withdrawal of spending from the economy leads to knock-on effects and a bigger final fall in real GDP. For example, if the government cut spending by £10bn, this would cause a fall in aggregate demand of £10bn.

Q. What is the Keynesian multiplier formula?

When an individual’s income increases, the marginal propensity to save (MPS) measures the proportion of income the person saves rather than spend on goods and services. It is calculated as MPS = ΔS / ΔY.

Q. What is the multiplier principle?

MULTIPLIER PRINCIPLE: The cumulatively reinforcing induced interaction between consumption, production, factor payments, and income that amplifies autonomous changes in investment, government spending, exports, taxes, or other shocks to the macroeconomy.

Q. When MPC is 0.9 What is the multiplier?

The correct answer is B. 10. The multiplier is found by {eq}/text Multiplier = 1 /div (/ 1- Marginal /space Propensity /space to /space…

Q. What is the importance of multiplier?

The concept of ‘Multiplier’ occupies an important place in Keynesian theory of income, output and employment. It is an important tool of income propagation and business cycle analysis. According to Keynes, employment depends upon effective demand, which in turn, depends upon consumption and investment (Y = C + I).

Q. Why is the multiplier greater than 1?

Why is the Multiplier Greater Than 1? The multiplier is greater than 1 because an increase in autonomous expenditure induces further increases in aggregate expenditure—induced expenditure increases.

Q. Why is the multiplier smaller in an open economy?

An increase in government spending leads to an increase in output and to a trade deficit. The effect of government spending in the open economy is smaller—the multiplier is smaller—than it would be in a closed economy. The trade balance improves because the increase in imports does not offset the increase in exports.

Q. Can a multiplier be less than 1?

In certain cases multiplier values less than one have been empirically measured (an example is sports stadiums), suggesting that certain types of government spending crowd out private investment or consumer spending that would have otherwise taken place.

Q. Can money multiplier be less than 1?

Problem 5 — Money multiplier. It will be greater than one if the reserve ratio is less than one. Since banks would not be able to make any loans if they kept 100 percent reserves, we can expect that the reserve ratio will be less than one. The general rule for calculating the money multiplier is 1 / RR.

Q. What is the simple deposit multiplier formula?

The simple deposit multiplier is ∆D = (1/rr) × ∆R, where ∆D = change in deposits; ∆R = change in reserves; rr = required reserve ratio. The simple deposit multiplier assumes that banks hold no excess reserves and that the public holds no currency.

Q. What is the minimum value of money multiplier?

Minimum value of multiplier is 1.As the Multiplier depends on MPC.So,When MPC is at its lowest e.g.0,then 1/1-0 will be equal to one.

Q. What are the determinants of money multiplier?

The size of the money multiplier is determined by the currency ratio (Cr) of the public, the required reserve ratio (RRr) at the central bank, and the excess reserve ratio (ERr) of commercial banks. The lower these ratios are, the larger the money multiplier is.

Q. What is the maximum amount the bank can create?

Maximum new loan amount of the banks is equal to the excess reserve held by the banks. Deposits at banks are insured by the FDIC. Such insurance guarantees deposits in amounts of up to $100,000 per depositor before the 2008 recession. Since then, the amount is increased to $250,000.

Q. What is Money Multiplier what determines the value of this multiplier?

Money supply in the economy is determined by the size of multiplier (m) and the amount of high powered money (H). Suppose the value of m = 1.5 and that of H = र 1000 crores. Then total money supply (H) will be 1000 x 1.5 = र 1500 crores. In short, this is the process of money creation.

Q. How does LRR affect the value of money multiplier?

Money Multiplier = 1/LRR. In the above example LRR is 20% i.e., 0.2, so money multiplier is equal to 1/0.2=5.

Q. What is Money Multiplier what determines the value of this multiplier Class 12?

Money multiplier measures the amount of money that the banks are able to create in the form of deposits with every unit of money, it keeps in reserves. Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) play an important role in the determination of money multiplier.

Q. What is meant by deposit multiplier?

The deposit multiplier is the maximum amount of money a bank can create for each unit of reserves. The deposit multiplier is normally a percentage of the amount on deposit at the bank. The deposit multiplier requirement is key to maintaining an economy’s basic money supply.

Q. How do banks create money from a $1 000 deposit?

If you put $1,000 in the bank, the bank is allowed to take some of that money and lend it out to someone else. You might earn around 1% interest on the money in a high-yield savings account, but the bank can turn around and loan most of that money out for a mortgage loan at 4%, or a car loan at 2.99%.

Q. Which function of money does a penny not serve well?

There is much debate about whether the U.S. government should eliminate the penny from circulation and instead round all prices to the nearest 5 cents for everyday cash transactions. Which function of money does a penny not serve well? d) The penny does not serve any of the functions of money well.

Q. Can banks loan more money than they have?

Banks are thought of as financial intermediaries that connect savers and borrowers. However, banks actually rely on a fractional reserve banking system whereby banks can lend more than the number of actual deposits on hand. This leads to a money multiplier effect.

Q. Where do banks borrow money from?

Key Takeaways. Banks can borrow from the Fed to meet reserve requirements. These loans are available via the discount window and are always available. The rate charged to banks is the discount rate, which is usually higher than the rate that banks charge each other.