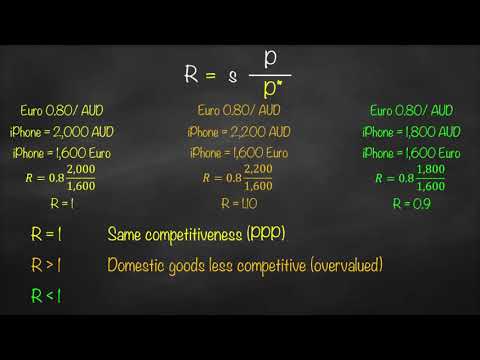

The real exchange rate (RER) between two currencies is the product of the nominal exchange rate (the dollar cost of a euro, for example) and the ratio of prices between the two countries.

Q. What does it mean if the real exchange rate is less than 1?

If it is less than 1, the foreign currency is undervalued relative to the domestic currency.

Table of Contents

- Q. What does it mean if the real exchange rate is less than 1?

- Q. When the real exchange rate decreases a country’s net exports will?

- Q. What happens when the real exchange rate depreciates?

- Q. What causes real exchange rates increase?

- Q. What is the difference between NEER and REER?

- Q. How is exchange rate determined?

- Q. What does the exchange rate depend on?

- Q. How does exchange rates affect inflation?

- Q. What causes exchange rate volatility?

- Q. What is the effect of exchange rate volatility?

- Q. Why foreign exchange rate is important?

- Q. What are the five major factors that influence foreign exchange rates?

- Q. What is foreign exchange example?

- Q. What are the types of exchange rate?

- Q. Can I be an exchange student?

Q. When the real exchange rate decreases a country’s net exports will?

In this case, import is likely because foreign goods are cheaper, in real terms, than domestic goods. Thus, when the real exchange rate is high, net exports decrease as imports rise. Alternatively, when the real exchange rate is low, net exports increase as exports rise.

Q. What happens when the real exchange rate depreciates?

After the domestic real interest rate rises the exchange rate appreciation reduces net exports. If the foreign country’s real interest rate rises the supply of domestic currency increases, the exchange rate depreciates, and the domestic country net exports rise.

Q. What causes real exchange rates increase?

Interest rates, inflation, and exchange rates are all highly correlated. Higher interest rates offer lenders in an economy a higher return relative to other countries. Therefore, higher interest rates attract foreign capital and cause the exchange rate to rise.

Q. What is the difference between NEER and REER?

The NEER is the weighted geometric average of the bilateral nominal exchange rates of the home currency in terms of foreign currencies. The REER is the weighted average of NEER adjusted by the ratio of domestic price to foreign prices.

Q. How is exchange rate determined?

Currency prices can be determined in two main ways: a floating rate or a fixed rate. A floating rate is determined by the open market through supply and demand on global currency markets. 4 Therefore, most exchange rates are not set but are determined by on-going trading activity in the world’s currency markets.

Q. What does the exchange rate depend on?

Exchange rates are determined by factors, such as interest rates, confidence, the current account on balance of payments, economic growth and relative inflation rates.

Q. How does exchange rates affect inflation?

How the exchange rate affects inflation. A depreciation means the currency buys less foreign exchange, therefore, imports are more expensive and exports are cheaper. Imported inflation. The price of imported goods will go up because they are more expensive to buy from abroad.

Q. What causes exchange rate volatility?

Generally, the causes of exchange rate volatility can be grouped into domestic real shocks affecting supply, domestic real shocks affecting demand, external real shocks and nominal shocks reflecting changes in money supply.

Q. What is the effect of exchange rate volatility?

In some studies, the exchange rate volatility creates uncertainty in the economic environment and decreases investment. The decrease in investment has a negative impact on economic performance.

Q. Why foreign exchange rate is important?

The exchange rate is important for several reasons: a. It serves as the basic link between the local and the overseas market for various goods, services and financial assets. Using the exchange rate, we are able to compare prices of goods, services, and assets quoted in different currencies.

Q. What are the five major factors that influence foreign exchange rates?

5 factors that influence exchange rates

- Inflation. The rate at which the general level of prices for goods and services is rising is known as the inflation rate.

- Interest rates.

- Speculation.

- Balance of payments/current account deficit.

- Public debt.

Q. What is foreign exchange example?

Foreign Exchange (forex or FX) is the trading of one currency for another. For example, one can swap the U.S. dollar for the euro. Foreign exchange transactions can take place on the foreign exchange market, also known as the forex market.

Q. What are the types of exchange rate?

The three major types of exchange rate systems are the float, the fixed rate, and the pegged float.

Q. Can I be an exchange student?

There are two main types of exchange programs ― ‘Study Abroad’ and ‘Student Exchange’ programs. Whether you are a high school or college student, you will require either a J-1 or F-1 visa. The visa type will depend on the program you are enrolling in. A study abroad program will form part of your academic credits.